Draft determinations research

Introduction

The 2024 Price Review marks arguably the most significant price-setting period in the water sector’s history – both for consumers and the environment. Investment is needed on an unprecedented scale to clean up our rivers and seas and future-proof the reliability of services in the face of climate change and population growth. Customers’ bills are set to increase significantly to fund this investment – creating or deepening affordability difficulties for many customers. This is why it is imperative customers have a strong say and influence over the decisions that affect their bills and services.

Back in July 2024, Ofwat published its initial proposals – known as draft determinations – setting out what customers of every water company will pay and what their supplier will be expected to deliver in return, in terms of investment and service levels. These proposals would lead to the biggest ever package of investment in the water environment. Overall, investment across the period 2025-26 to 2029-30 would total £88 billion. However customers’ bills would increase by an average of £19 a year over the next five years. That marks a 21% increase before the impact of inflation, which is automatically added to water bills each year.

We felt it was vital customers had an opportunity to have their say on both the proposed bill changes and what they stand to get in return. This is why, with support from the regulator Ofwat, we commissioned research to gauge household customers’ views on the plans. This research was carried out with more than 9,500 customers across England and Wales (a sample of around 500 for each supplier) during August and September 2024. It looked specifically at how affordable people felt the bill changes would be for them and how acceptable they found the package of investment in service improvements. The research was carried out in a way to ensure the sample of customers was representative of wider household bill-payers.

This page provides a summary of the key findings to emerge from our research with household customers. We’ve focused on the headline findings for England and Wales across affordability and acceptability of the draft determinations. There are some instances where we have highlighted a significant difference in the result for Wales, compared to the overall average.

Detailed breakdown of the findings can be found in the full report (pdf)

Separately, we also carried out research to understand the views of non-household customers in England and Wales.

Headline findings

Our research began by establishing the extent to which cost-of-living pressures were currently affecting customers’ ability to pay household bills. It revealed that 42% of customers across England and Wales had struggled to pay at least one of their household bills in the last year. This increased to 45% when looking just at the views of customers in Wales. It also showed that almost 1 in 5 households (18%) are currently finding it ‘quite’ or ‘very’ difficult to manage financially.

Customers were then asked how easy they find it to afford their current water bill. 45% of households felt their current water bill was easy to afford, while almost a fifth (18%) said it was difficult to afford.

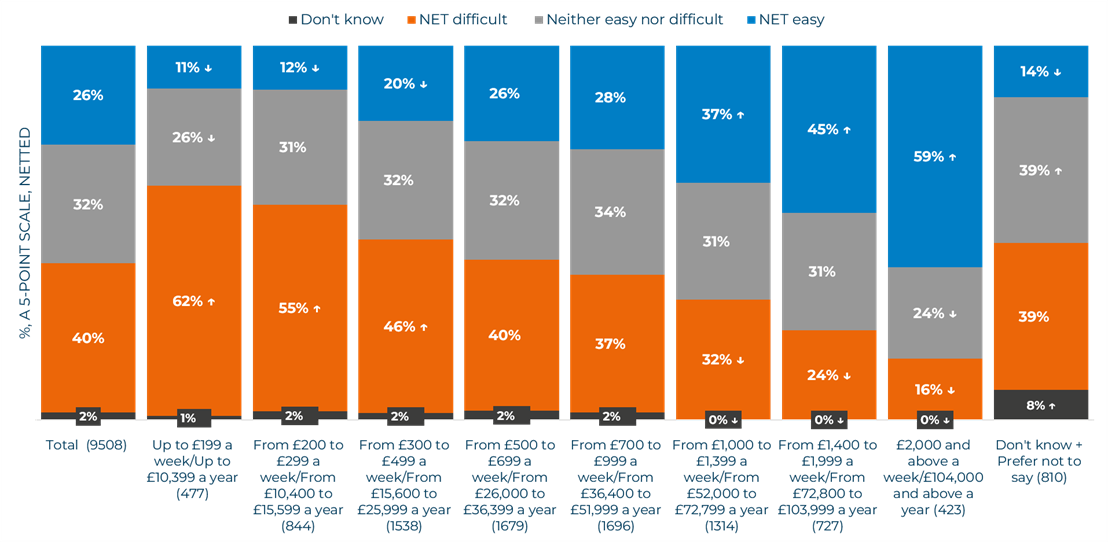

People’s income levels had a significant bearing on their ability to afford their current bill. Unsurprisingly, lower-income households faced the biggest hardship in being able to pay their water bills.

Customers were then presented with the proposed changes to their company’s average water bill over the next five years from 2025-26 to 2029-30, based on Ofwat’s draft determinations and including forecast inflation. The level of customers who felt the proposed bills would be easy to afford dropped from 45% (current levels) to only 26%.

Of even greater concern, was the fact 2 out of 5 customers (40%) across England and Wales said the bill rises being proposed over the next five years would be difficult to afford. This was markedly higher when looking just at Wales (48%).

Customers who said they would find it difficult to afford the future bill levels proposed by Ofwat were asked what steps they might take to be able to pay them. 54% said they would spend less on non-essentials and 43% would use less water. 38% said they would cut back on food shopping and money spent on other essentials.

The second phase of the research looked more specifically at what customers would get in return for their money and whether the package of proposed investment and service improvements was acceptable to them.

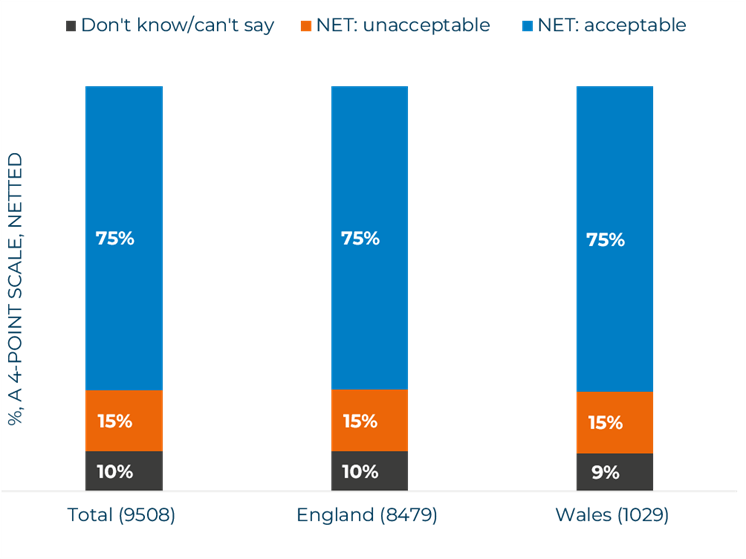

75% of customers found the proposals acceptable. This varied significantly across the companies, with 81% of Severn Trent Water customers accepting the plans and just 65% of Southern Water customers in support of them. Acceptability was highest among customers who found the proposed bills for 2025-26 to 2029-30 affordable.

When customers were reminded of the proposed bill rises they had been shown earlier in the research, acceptability levels in England and Wales dropped from an average of 75% to 58%. This was significantly lower in Wales where it dropped to 52%.

Current and future affordability of water bills

Our research should leave no one in any doubt of the financial hardship facing many people across England and Wales. Just over 2 in every 5 households (42%) told us they had struggled to pay at least one household bill over the past year.

When asked more specifically about water and sewerage, almost a fifth (18%) said they found their current bill difficult to afford. This doubled (40%) though when customers saw their company’s proposed year-by-year increase for 2025-26 to 2029-30, based on Ofwat’s draft determinations and including the impact of forecast inflation. The worries were even greater among households in Wales, where nearly half (48%) of customers said they would find the proposed rises in water bills difficult to afford.

Unsurprisingly, income levels have a huge bearing on whether people feel they will be able to afford the bill rises, which on average could climb by around 21% – or 33% once forecast inflation is taken into account.

For example, just over half of customers (55%) earning less than £15,600 a year said they would find the bill rises difficult to afford.

Arrows next to the numbers mark significant differences from the total. ↑ = significantly more ↓ = significantly less on a 95% confidence level.

A compelling case to end water poverty

These findings reinforce the pressing need for Ofwat and water companies to improve the package of support offered to households struggling on a low income and still feeling the effects of the cost-of-living crisis.

CCW estimates as many as 2 million customers across England and Wales are currently living in water poverty – whereby they are spending 5% or more of their income (after housing costs) on water bills. Only Northumbrian Water, Wessex Water, South West Water (including Bristol Water and Bournemouth Water), Severn Trent Water and Thames Water have set out plans to end water poverty by 2030.

When water companies published their original business plans back in October 2023, it was estimated around 1.2 million customers would remain in water poverty by the end of the decade. Our research strongly suggests the proposed bill rises will tip the balance for some customers who are not currently eligible for financial assistance.

Water companies in England made a public commitment (pdf) to end water poverty by 2030. They should keep their promise and Ofwat should make this the target that companies are measured against when it makes its final decisions in December 2024.

CCW remains convinced that the introduction of a single social tariff for England and Wales would provide the most effective solution to ending water poverty. Companies’ existing social tariff schemes are providing valuable support to around 1.6 million customers, but remain constrained by differences in eligibility and funding. This has created a postcode lottery which a single social tariff would help to end. Funding this from a shared pot into which all water consumers contribute would help to avoid costs falling most heavily on customers in regions with the biggest poverty problems.

Customer support for investment

Ofwat’s draft determinations would lead to a package of investment and service delivery improvements over the next five years which would total £88 billion. A large aspect of this investment would be the funding of measures to reduce pollution of the natural environment, particularly cleaning up our rivers, streams and coastal waters.

These investment plans come against the backdrop of rising public concerns over the state of our rivers and bathing waters and the impact of pollution from storm overflows. These environmental concerns have fuelled declining trust and satisfaction with water companies – as evidenced by our Water Matters research published in May 2024.

Rebuilding trust and consumer confidence in the water sector is dependent on water companies delivering the standards of service and environmental protections that people want and expect. To gauge whether Ofwat is on the right track, we tested whether the package of improvements was acceptable to customers.

Customers were shown information summarising how their water company was currently performing in areas ranging from leakage and sewer flooding to water supply interruptions and drinking water quality. They were then shown the five-year investment proposals for their company and asked whether they found them acceptable and what they considered a priority.

An average of 75% of customers across England and Wales found the investment proposals acceptable. This varied across companies as the chart below shows.

Arrows next to the numbers mark significant differences from the total. ↑ = significantly more ↓ = significantly less on a 95% confidence level.

Those customers who considered the future bill rises to be affordable, were more likely to find the overall package of investment acceptable.

The 15% of customers who found the plans around investment unacceptable cited companies’ profits being too high; a lack of trust in companies fulfilling their commitments and the impact of bills being too high, as their main reasons for not supporting it.

Customers’ investment priorities

The research also examined what customers viewed as a priority for their company to deliver over the next five years, across wastewater and water services.

Improving river water quality and reducing spills from storm overflows were the highest priorities for people under wastewater services. Leakage reduction topped the list of priorities for customers when it came to water services.

These were the most common priorities when looking at England and Wales as a whole, although there were some significant variations at a company level.

While our research shows that the majority of customers accept the proposed improvements for their company, the fragility of this support became apparent when customers were reminded of the bill changes they face. Acceptability dropped, on average, from 75% to 58% when customers were reminded of this.

This underlines why the stakes have never been higher when it comes to companies delivering on their five-year commitments. Companies risk igniting a deeper crisis in customer trust and satisfaction if bill-payers’ expectations are not met – particularly when they are paying a much higher price for these services.

CCW supports Ofwat’s introduction of price control deliverables and similar mechanisms that will return money back to customers if companies fail to deliver projects, or are delayed in delivering them. But ultimately what matters most to customers is seeing and experiencing a difference in their service and the state of the environment.

We will continue to track customers’ trust and satisfaction with the sector through our annual Water Matters survey. Companies cannot allow for perceptions of the sector to slide any further.

Next steps

These findings support many of the recommendations we made to Ofwat when we submitted our response to its draft determinations back in late August. In particular, the need for the regulator to demand more from water companies on supporting customers struggling to pay their bills.

The case for a single social tariff has never been more compelling, given that 40 per cent of households say they will find it difficult to afford the water bill rises Ofwat has proposed. These concerns are even more prevalent among customers on lower incomes. A failure to put in place more comprehensive and better targeted support risks further exposing the limitations in existing financial assistance. We will continue to campaign for a single social tariff and for the sector to deliver on its commitment to end water poverty by 2030.

We have already shared this research report with Ofwat to help shape and influence its final decisions, which are expected in December 2024. We want to see evidence in these decisions that customers’ concerns – particularly on affordability – have been heard and addressed.