CCW’s response to Ofwat’s 2025-30 draft price determination

Introduction

The price review for 2025-30 (PR24) is a hugely important one. Meaningful investment is needed to sort out the issues the water industry hasn’t tackled in the past. That investment will be needed for decades to come, not just in this five-year period. The risk is that if water companies cannot deliver results for the increased bills they’re asking customers for during 2025-30, they will find it incredibly difficult to ask for more in 2029 to continue that investment.

CCW’s latest annual customer tracker survey Water Matters paints a grim picture of how consumers view their water companies. All companies recorded their lowest ever score for customer trust. In addition, we saw the largest ever fall in trust in a single year. So it is vital that customers can see what is being delivered in return for their bills going up, whether that’s having the confidence to swim at their beach or enjoying a more reliable water supply.

CCW’s role in the price review process

The Consumer Council for Water (CCW) is the statutory consumer organisation representing household and non-household water and sewerage consumers in England and Wales. Because customers cannot choose their water provider, it’s especially important that their voices are heard in how the sector delivers their services and protects the environment.

CCW is an integral part of the five-yearly price review process. We scrutinise water companies’ business plans and Ofwat’s determinations on those plans to make sure the customer voice is heard at every stage of the process.

Since Ofwat published its draft determinations in July 2024, CCW teams have been going through them in detail. This overview document provides our views on issues that feature in all or most of the companies’ plans. We have also produced and submitted specific detailed assessments of each company’s plans.

CCW is also carrying out research to test the package of bill changes, service improvements and investments in these draft determinations for customer acceptability and affordability. We are surveying thousands of household customers and conducting in-depth interviews with a small sample of non-household customers (businesses). CCW will provide Ofwat with the results of the research as soon as we have them in September 2024.

Executive summary

On average, the household bill for water and sewerage will rise by 21% before inflation by 2030. Taking inflation into account (OBR forecast), the average rise is 32%.

When all the water companies’ business plans were tested in 2023, only 16% of customers found the companies’ proposals affordable now or in the future. The cost-of-living crisis may well still be affecting many people and businesses when these bill rises come into effect in April 2025. Although the rises are likely to be lower than those originally set out in the October 2023 business plans, they will still be unwelcome to many households.

CCW estimates that about 2 million households across England and Wales are currently living in water poverty – which means they are spending more than 5% of their income after housing costs on their water bills.

CCW wants Ofwat and the water companies to show they take ending water poverty seriously by starting with that as a target and measuring all water companies’ business plans against it. But with one exception, CCW can find no evidence that Ofwat has challenged the water companies about their affordability support proposals.

Water companies in England made a public commitment to end water poverty by 2030. And Ofwat’s Welsh Government priorities document states that Ofwat expects the two water companies in Wales to meet their commitment to eradicate water poverty by 2030. CCW believes all water companies in England and Wales should deliver on their commitments. But so far, only five companies have publicly committed to eradicating water poverty.

The number of customers supported by social tariffs will increase in 2025, but CCW believes that doesn’t go far enough. Although the draft determination bills are likely to be lower than what was proposed in the business plans, the number of people in water poverty is still likely to be around a million in 2030. CCW finds that unacceptably high.

A single social tariff would end water poverty and the current postcode lottery of support. Funding this from a shared pot into which all water consumers contribute would help avoid costs falling most heavily on customers in regions with the biggest poverty problems. This is particularly needed to address the current cost-of-living crisis.

Apart from a brief mention in the quality assessment summaries, CCW can find little explanation of how much Ofwat assessed the quality and extent of the companies’ customer engagement and challenge to the business plan, or how that may have influenced its draft determinations.

This is particularly disappointing considering the requirements Ofwat placed on companies in relation to transparency about the use of evidence from customer engagement in its decision making. Ofwat has not followed its own guidance in its draft determinations.

Expenditure on enhancements to the water network has tripled from PR19 to £35 billion. 90% of that is for statutory environment programmes that are now required by UK law. Customers broadly support the outcomes that these schemes should deliver.

£11 billion in PR24 is earmarked to spend on storm overflows to make sure there are only 16 spills per overflow per year by 2029-30 in England and a 2029-30 average spills target between 20-30 spills per overflow in Wales. Although CCW welcomes these targets, customers need to know that the most harmful storm overflows are being prioritised and that companies are not just tackling the “easy” ones. CCW wants to see companies collecting and using data to produce – and share publicly – delivery plans that clearly prioritise reducing harm and improving the environmental health of our rivers and seas.

CCW is pleased to see £2.2 billion in PR24 is to be spent on nature-based solutions, including £1.6 billion to reduce storm spills through sustainable drainage systems (eg wetlands). Our December 2023 research shows that households would be willing to pay up to £40 a year more on their water bill to use nature instead of man-made materials to improve river water quality and reduce the risk of flooding.

CCW’s overview of Ofwat’s 2024 draft determinations

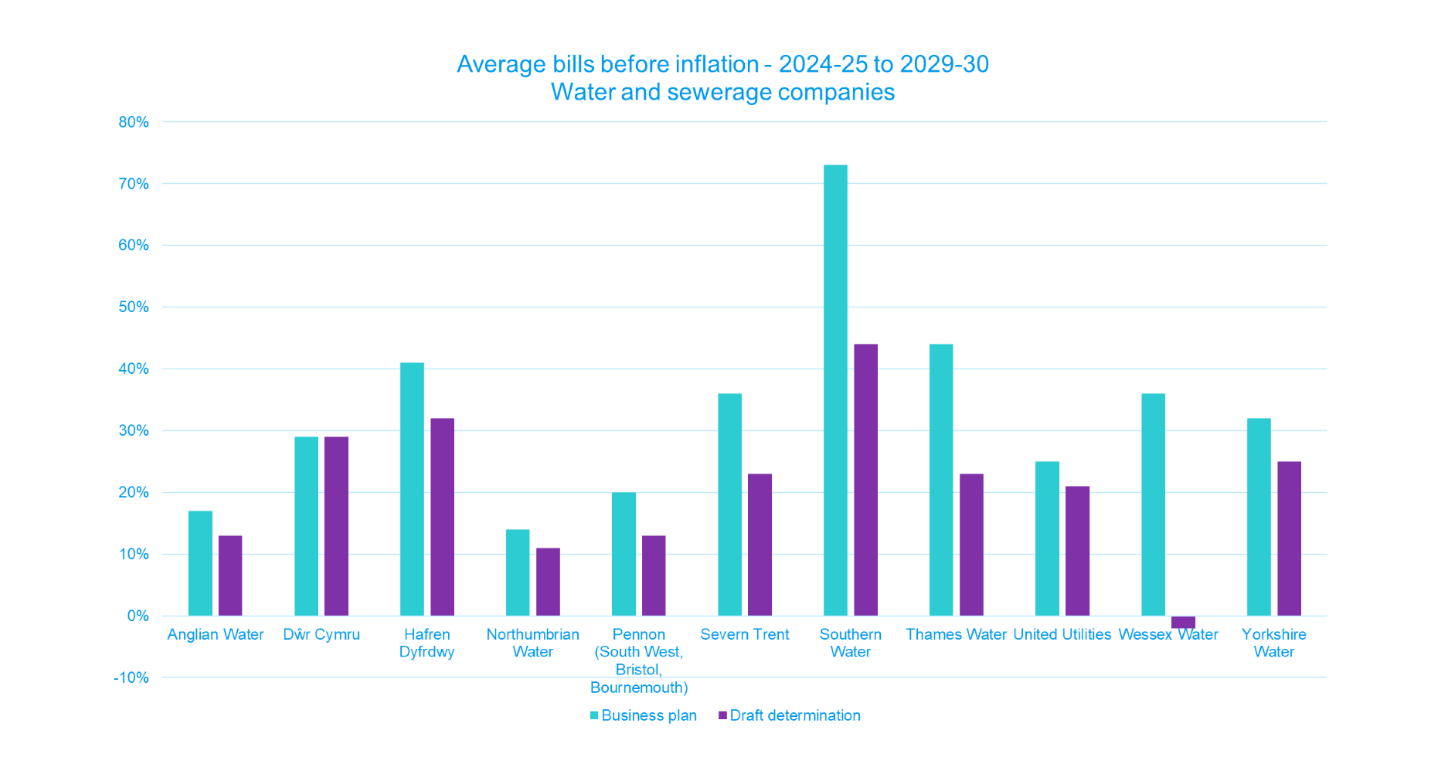

On average, the household bill for water and sewerage for 2025-30 will rise by 21% before inflation. Taking inflation into account (OBR forecast), the average rise is 32%. The overall rise proposed across all the water companies in their business plans was 33% (before inflation) – so Ofwat has taken 12% off the overall average water and sewerage bill, compared with what the companies asked for in their revised plans in spring 2024.

View enlarge graph for water and sewerage companies (png)

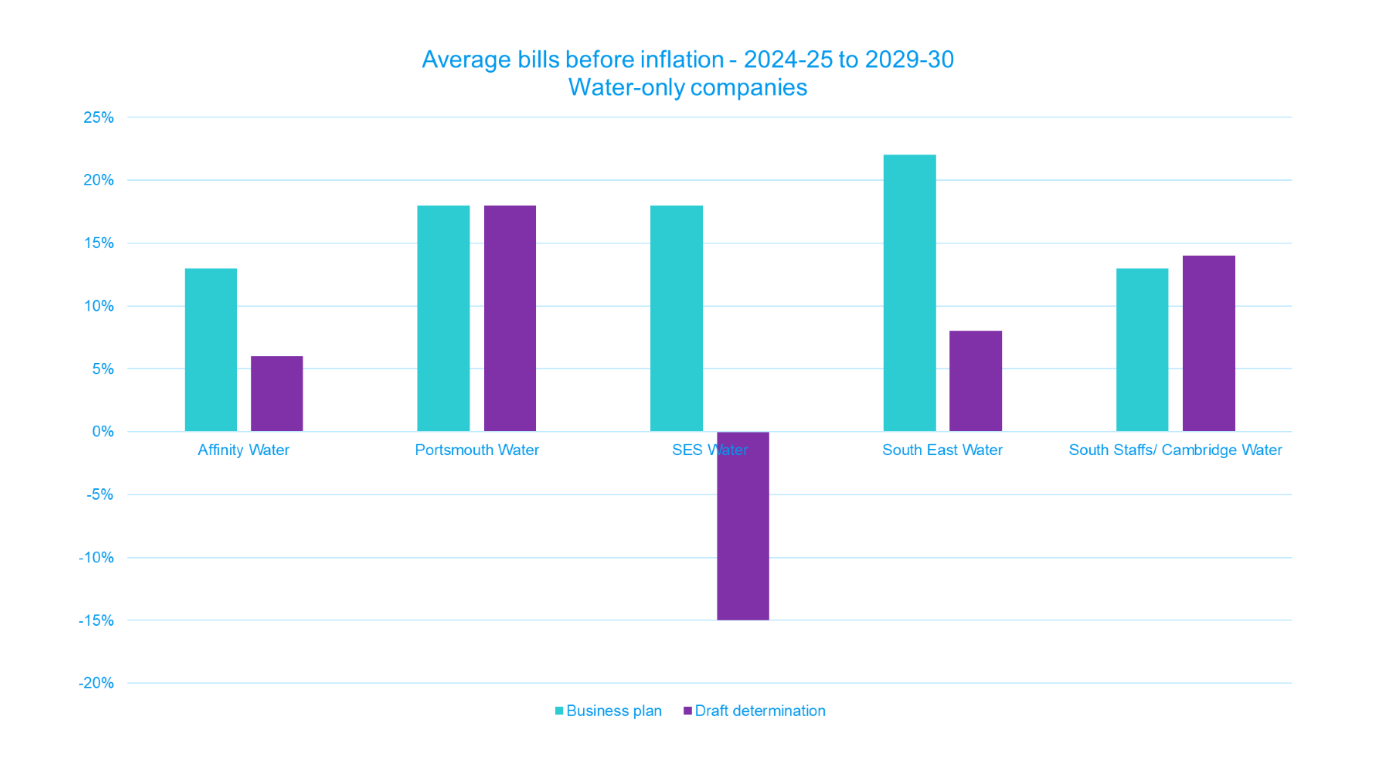

View enlarge graph for water only companies (png)

Changes in 2025-30 bills for individual water companies in these draft determinations range from –15% (SES Water) to +44% (Southern Water) – both before inflation. With inflation added, that range is +8% to +60%.

When all the water companies’ business plans were tested in 2023, only 16% of customers found the companies’ proposals affordable now or in the future. Ofwat’s March 2024 Wave Five of its Cost of Living research found that 9% are receiving support with their water bill (up from 6%). 28% of bill payers said they would be concerned if there was a £5 monthly increase in their household costs. This rises to 54% of those currently struggling with their water bill.

The cost-of-living crisis may well still be affecting many people and businesses when these bill rises come into effect in April 2025. So although the rises are likely to be lower than those originally set out in the October 2023 business plans, they will still be unwelcome to many households. This is particularly true in Wales, where customers of both water companies (Dŵr Cymru and Hafren Dyfrdwy) are set to have among the highest price increases.

CCW’s latest annual customer tracker survey Water Matters paints a grim picture of how consumers view their water companies. All companies recorded their lowest ever score for customer trust. In addition, we saw the largest ever fall in trust in a single year. So it is vital that customers can see what is being delivered in return for their bills going up, whether that’s having the confidence to swim at their beach or enjoying a more reliable water supply.

In December 2024, the bills will be set for each year from 2025 to 2030. They are not necessarily the same amount every year. The research that many companies did to inform their business plans showed that most customers prefer bills to stay as similar as possible every year, rather than spiking in one or two years then going down again.

CCW is pleased to see that 5 out of 16 companies have smooth bill profiles – Affinity Water, Anglian Water, Severn Trent, South East Water and United Utilities. But Ofwat has allowed Southern and Dŵr Cymru to load costs quite heavily into the first year of the five-year period.

With the exception of South East Water, CCW can find no evidence that Ofwat has challenged the water companies about their affordability support proposals. It looks as if Ofwat has simply noted what was in the companies’ business plans. CCW wants Ofwat and the water companies to show they take ending water poverty seriously by starting with that as a target and measuring all water companies’ business plans against it. CCW wants to see this in Ofwat’s final determinations which will be published in December 2024.

Water companies in England made a public commitment to end water poverty by 2030. And Ofwat’s Welsh Government priorities document states that Ofwat expects the two water companies in Wales to eradicate water poverty by 2030. CCW believes all water companies in England and Wales should deliver on their commitments. So far, only five companies – Northumbrian Water, Wessex Water, South West Water (including Bristol Water and Bournemouth Water), Severn Trent and Thames Water – have publicly committed to eradicating water poverty.

CCW estimates that about 2 million households across England and Wales are currently living in water poverty – which means they are spending more than 5% of their income after housing costs on their water bills.

Although the number of customers supported by social tariffs will increase in 2025, from 4% now to 8% (in the region of 1.5m households), CCW believes that doesn’t go far enough given the context of rising bills. In October 2023, when companies published their business plans, companies forecast that 1.2 million households would still be in water poverty by 2030. Although the draft determinations suggest that final bills are likely to be lower than what was in the business plans, the number of people in water poverty is still likely to be around a million in 2030. CCW finds that unacceptably high.

CCW welcomes companies committing shareholders’ contributions or future profits or rewards to help fund affordability support. We commend United Utilities, Dŵr Cymru, Yorkshire Water, Northumbrian Water, Thames Water and SES on their proposals to make significant shareholder contributions towards social tariffs and/or other support.

Companies should not just rely on cross-subsidies from a water company’s other customers to support financially vulnerable households. A single social tariff would end water poverty and the current postcode lottery of support. Funding this from a shared pot into which all water consumers contribute would help avoid costs falling most heavily on customers in regions with the biggest poverty problems. This is particularly needed to address the current cost-of-living crisis.

Apart from a brief mention in the quality assessment summaries, CCW can find little explanation of how much Ofwat assessed the quality and extent of the companies’ customer engagement and challenge to the business plan, or how that may have influenced its draft determinations.

In Ofwat’s main Delivering Outcomes for Customers and the Environment (pdf) document, the only mention of customer engagement having any influence is where it states that customer support may be used in support of a bespoke performance commitment.

Ofwat’s Your Water Your Say report (pdf) from summer 2024 implies it has considered a larger suite of evidence:

Evidence from ‘Your water, your say’ surveys forms part of the suite of evidence of customers’ and stakeholders’ views that we have considered for our Draft Determination.

However, we cannot find this suite of evidence in the supporting published documents. Given the scale of research and engagement that took place to inform the companies’ business plans – including the work of Independent Customer Challenge Groups – summarising this effort in a few lines sends the signal that customers’ views do not matter.

This is particularly disappointing considering the requirements Ofwat placed on companies in relation to transparency about the use of evidence from customer engagement in their decision making. In its 2022 position paper PR24 and beyond: Customer engagement policy (pdf), Ofwat stated that:

Companies should be able to demonstrate how they have taken account of evidence from customer engagement. Companies should be able to explain why they have not taken account of evidence from customer engagement or research wherever this is the case

CCW believes that meaningful customer research and engagement must be a key part of decision making for future investment. Ofwat has not followed its own guidance in its draft determinations.

Expenditure on enhancements (building new infrastructure) has tripled from the last price review (2020-2025) to £35 billion. 90% of this money is to pay for statutory environment programmes that are now required by the Environment Act 2020 and other legislation. £11 billion of that money will fund improvements to 2,533 storm overflows and remove over 176,000 spills by 2029. And £6 billion is to be spent on nutrient removal.

Company business plan testing showed that customers broadly support the outcomes that this massive environment programme should deliver. As it makes up the lion’s share of the bill increases, customers will expect to notice the difference in the next five years, or to understand how things will improve over a longer period.

CCW is pleased to see £2.2 billion is to be spent on nature-based solutions, including £1.6 billion to reduce storm spills through sustainable drainage systems (SuDS) and wetlands. Our December 2023 research shows that households would be willing to pay up to £40 a year more to use nature instead of man-made materials to improve river water quality and reduce the risk of flooding. The public understand the risks involved with nature-based solutions and accept that risk in order to gain the benefits. The more nature-based solutions are successfully used, the more information will be available to the industry to roll out the ones that are effective.

CCW supports Ofwat’s incentives to encourage water companies to maintain the monitors on storm overflows. This is important for environmental transparency, and will help to rebuild trust in the sector.

CCW also supports the water companies who are going above and beyond on their statutory programme with innovative approaches to improving the environment eg Anglian Water’s advanced Water Industry Environment Programme, which will deliver improvements above and beyond the statutory minimum, and United Utilities’ bespoke commitment to reduce pollution in Lake Windermere. We want to see learnings from innovations like these shared with the wider sector.

CCW is broadly supportive of the drinking water improvement programmes. We know that customers put a high priority on drinking water quality. Delivering this programme successfully should mean customers have to contact their water company less often to complain about the smell, taste or appearance of their tap water.

CCW has concerns about how the statutory investment programmes in England and Wales plan to tackle storm overflows.

A storm overflow could be spilling frequently, but not causing as much environmental harm as another spill in a different location where the spill gets more diluted. So to major only on the number of spills will not fully address the problem. CCW knows that customers want the environmental health of their rivers to improve. So Ofwat should ensure that water companies prioritise the most harmful and higher-risk storm overflows. All companies must gather enough data to be able to do this. Companies should also make their storm overflow prioritisation plans – and the reasons behind them – available to their customers by April 2025, when the bills go up.

Currently, discharges are permitted to occur “in exceptional circumstances”. Ultimately, CCW wants the environmental regulators in England and Wales to rewrite all storm overflow consents to make them stricter and clearer about when spills are legal. To achieve this, consents (licences) should be modified so spills are only legal when the Met Office defines the weather as “exceptional”. Fining water companies then becomes an automatic and objective process that gives the final say to recognised experts.

CCW questions whether companies are doing enough to stop storm overflows spilling in the first place by preventing or removing blockages in the sewer system. The Environment Agency identified in 2021-23 that 18% of high-spilling overflows are due to operational issues including poor maintenance.

The delivery of the storm overflow programme and the monitoring of spills and harm must be transparent and easy to understand as the public are very interested in this topic.

Ofwat’s draft determinations broadly support the companies’ water resource management plans (WRMPs). CCW was consulted on all the water companies’ WRMPs. The water companies have adopted a twin-track approach – maximising availability of water supplies, while also reducing the demand for water through reduced consumption and leakage. CCW supports this approach. In companies’ research into their business plans, customers always put resilience of water supply as a very high priority.

CCW will keep working with companies on how they will engage with customers on behaviour change to reduce demand for water. The Environment Agency’s March 2024 review of draft Regional Water Resource Plans found an additional 4,800 million litres of water a day will be needed in England by 2050. Yet Ofwat says that per capita consumption reduction targets will not be met for the five-year period 2020-25. And all water companies except one are reporting consumption that’s higher than 2019-20 (before Covid). CCW wants companies to be clear with their customers about how they will work towards achieving improvements in per capita consumption by helping people and businesses reduce their water use.

This is particularly true regarding the rollout of smart meters. Ofwat has allowed £1.5 billion to install 10.3 million smart meters. Smart meters deliver a number of benefits – more real-time data should identify more leaks; homes and businesses can see details of their water consumption. So this smart meter programme for 2025-30 should contribute to a 13% reduction in leakage and a reduction in per capita consumption of 4%.

However, CCW would like to see more clarity about how companies will roll them out to households and businesses to prioritise areas most at risk of water scarcity. CCW would also like to see more details on how companies will feed back the data gathered by smart meters directly to customers so they can think about changing their behaviour. And we want to understand how increased smart metering will inform water companies’ design of innovative tariffs aimed at changing customer behaviour.

Given the issue of long unread meters that blights the business retail market, it’s vital that the smart meters are rolled out to business customers. It’s our understanding that the unit cost of installing smart meters is different for households and business customers. If this is not taken into account, it could lead to lower take-up of smart meters by businesses.

CCW understands that there is no historic data on demand management for business customers, so there is no baseline to use. Ofwat have set a three-year rolling average based on an assumption. CCW wants to see this updated as soon as real information starts flowing in.

CCW supports the aims of Ofwat’s proposed Water Efficiency Fund – we agree there is an urgent need for a new approach to increase the focus on demand management. We have submitted responses to both of Ofwat’s consultations.

The statutory programme is so big in this price review period (2025-30) that some projects that are not mandatory have been squeezed out, rescheduled or stretched over a longer time period.

Some issues that have been deprioritised are those that we know customers care about:

- carbon reduction

- resilience of pipes and treatment works to extreme weather

- some improvements to drinking water quality

CCW accepts that long-term plans always involve trade-offs. However, we are concerned that it’s unclear what the implications are for catching up after 2030 on the issues that have been postponed.

Ofwat has allowed £297 million to increase mains replacement rates. All companies will replace on average at least 0.3% of their entire water mains network every year 2025-30. This means 2.2% of each company’s mains network will be replaced by 2030.

Ofwat says that in the 2020-25 period, the rate of mains renewal fell to 0.1% a year. This is lower than the level that was expected from the allowances it granted in PR19.

CCW agrees that an increase is needed to keep service at an acceptable level given the risks of asset failure and leakage. But customers may question why they need to pay to ramp up mains replacement rate now when companies did not achieve the PR19 mains renewal expectation. They could justifiably ask what happened to the money they paid in 2020-25 that was supposed to go on replacing mains.

If mains replacement continues at the rates mandated in PR24, it will take hundreds of years to renew the whole network. CCW understands that mains replacement is costly, however, it also benefits the water companies by way of reduced leakage, fewer supply interruptions and less maintenance costs in the long term.

Ofwat has allowed £88 billion to be claimed as total expenditure in these draft determinations.

That’s lower than what companies asked for by £16 billion. CCW expects a regulator to reject any claims for unjustified, inefficient or previously funded proposals. So we are pleased to see Ofwat is saving customers from having to pay again for anything they have already paid for.

Other factors may increase or even decrease customers’ bills during the period 2025-30:

Outcome Delivery Incentives (ODIs)

ODIs give water companies rewards or penalties for especially good or bad performance.

Actual energy costs

CCW supports Ofwat’s proposal to set assumed energy costs at a baseline reflecting the government‘s industrial use index, and “true up” at PR29 if companies’ actual costs end up lower or higher. This protects customers from paying too much up front for what is a significant base cost driver (15% of base costs are for energy) in a volatile wholesale energy market. Ofwat’s use of the government index should also incentivise companies to achieve cost-efficient deals from their suppliers.

Delivery mechanisms

Two companies – Thames Water and Southern Water – are subject to delivery mechanisms. They have not been allowed all of the costs to deliver all their commitments until they can convince Ofwat they are on track in delivering for customers and the environment. If Ofwat is satisfied that they are delivering, they will be allowed the additional costs. If not, the money will stay in customers’ pockets and not be added to their water bills.

CCW approves of this – we don’t want to see customers paying for something if it’s not yet certain a water company can deliver it. We look forward to seeing the revised plans when they are submitted to Ofwat, and hearing the regulator’s judgment on them.

CCW also wants to know what happens if either of these companies fail to provide Ofwat with this assurance. That would mean the water companies won’t be delivering what customers are expecting. This will make these companies’ customers unhappy and will further erode trust in the wider water industry.

The multi-billion pound investment programme covered by these draft determinations has to be financed so it can deliver what customers have been promised. £7 billion in equity financing is needed. Ofwat has increased the set allowed rate of return from 3.23% to 3.72%. This is driven by a higher cost of equity, so this should attract investment into the sector. As an increased rate of return means higher bills, customers must see a return on their investment in the form of better services and a cleaner environment.

We also expect Ofwat to review its cost of capital assumption in the final determinations in light of changing market conditions and regulatory decisions in the energy sector before December 2024.

In principle, CCW approves of Ofwat’s move to encourage reduction of the risks posed by overly high gearing to delivering services for customers. As of 31 March 2022 and 2023, six water companies were reporting a gearing of 70% or more: Thames Water, Yorkshire Water, Affinity Water, Portsmouth Water, South East Water and SES Water. This high level of gearing may carry financial risks. We particularly welcome Ofwat’s introduction of incentives for water companies to list new equity on the stock exchange to encourage better transparency and governance.

CCW wants to see Ofwat reintroduce a financial outperformance mechanism to ensure customers get a share of any windfall that may come about from high gearing, unforeseen lower cost financing, or changes to inflation and interest rates.

The water industry needs to undertake large construction projects like reservoirs or sewage treatment works. These cost a lot of money to build. There has to be a balance between what current and future customers pay towards these projects, which will benefit customers for decades to come.

In its draft determinations, Ofwat has intervened so the rate of short-term cost recovery (the Pay-As-You-Go ratio) is different from what companies proposed. CCW is supportive where Ofwat has adjusted ratios so that costs are spread over a longer period than companies originally planned.

In principle, CCW also supports Ofwat’s use of gated investment schemes to ensure customers do not pay too much up front for infrastructure projects.

CCW supports Ofwat’s introduction of price control deliverables and similar mechanisms that will return money back to customers if companies fail to deliver projects, or are delayed in delivering them.

CCW supports Ofwat’s proposed financial resilience monitoring of four companies – Thames Water, Southern Water, South East Water and Wessex Water. It’s important that water companies’ capital structures are financially sustainable in the long term so they can deliver their commitments to customers and the environment. This monitoring, what it reveals and the actions needed must be as transparent as possible, while taking commercial sensibilities into account.

CCW is supportive in principle of direct procurement for very large infrastructure schemes eg new reservoirs. However, Ofwat must assure us that any schemes involving third parties are more efficient than in-house delivery, and that they will actually get delivered.

CCW supports the range of service improvements targeted under the 24 common performance commitments (PCs), including the 8 new environmental ones. Ofwat and CCW’s 2022 joint research on customer priorities shows that consumers supported these areas of performance.

CCW also supports Ofwat’s proposed new performance commitment to address serious water supply interruptions that last longer than 12 hours. We also very much welcome Ofwat’s new target of zero serious pollution incidents for all companies.

18 performance commitments – including leakage and sewer flooding – have absolute targets. This means the same reduction target applies to every water company. CCW questions whether absolute targets are sufficiently challenging for some poor performing companies. We also question whether some of the absolute targets are set high enough to address customers’ priorities.

For example, to the thousands of people whose properties are flooded every year, a 13% reduction in sewer flooding of houses will not look very challenging. It’s a lower target than what was set in the previous price review period (41%). CCW also believes the 13% target is insufficient because much of the infrastructure work to reduce storm overflow spills that water companies have committed to in PR24 should reduce overall sewer flooding.

In many cases, Ofwat has increased targets compared to what was in companies’ business plans. CCW supports this – targets must address poor performance, align with customer priorities and reflect the amount of money that Ofwat is allowing companies to charge.

CCW is pleased to see that Ofwat did not let sewer flooding performance commitments include exceptions for extreme weather.

Some companies have bespoke performance commitments to reflect their particular circumstances. CCW agrees Ofwat’s challenge to companies to prove that these are supported by customers. We are pleased to see fewer bespoke performance commitments overall than in PR19.

ODIs should incentivise companies to pursue customer priorities and address poor performance. Therefore the rates set for rewards and penalties should not inadvertently make it more cost-effective for companies to pursue payment for an easy-to-achieve outcome while absorbing the cost of a penalty for not achieving a harder outcome.

Ofwat is offering enhanced ODI rewards for water companies that reduce water supply interruptions, leakage, per capita consumption, internal sewer flooding, external sewer flooding and total pollution incidents. Because the money for ODI rewards is added onto bills, this means a company’s customers will pay more for their water company to perform better than other ones on things that many would assume are basic responsibilities for a service provider. CCW is also concerned that this mechanism isn’t transparent to customers – it is buried in the “small print” of ODIs. Enhanced ODI rewards are not part of affordability and acceptability testing. So Ofwat risks customers feeling “stealth taxed” by having to pay for something they didn’t agree to.

CCW is pleased that Ofwat has broadly applied the outcome delivery incentive reward and penalty rate that was set out in the methodology.

CCW continues to support the introduction of the Customer Experience measure (C-MeX) to measure and incentivise improvements in customer satisfaction with both contacts and non-contacts through the use of surveys and cross-sector comparators.

We support the increase in the financial value of this incentive for 2025-30, so it is relative to other ODIs, and the greater weighting in the satisfaction of customers who have had to contact their water company.

Ofwat’s move to set C-MeX targets based on the UKCSI all-sector average as a benchmark for a company’s customer satisfaction should see every company incentivised to improve to a level comparative with customer satisfaction with other sectors.

However, the draft determinations lack specific annual targets for companies to show the level of stretch needed from current C-MeX targets to reach the UKCSI benchmark. So CCW wants Ofwat to confirm that it will consult us further on this.

CCW is very disappointed that, after extensive engagement with Ofwat, an additional metric to measure customer complaint volumes is not part of the range of C-MeX components.

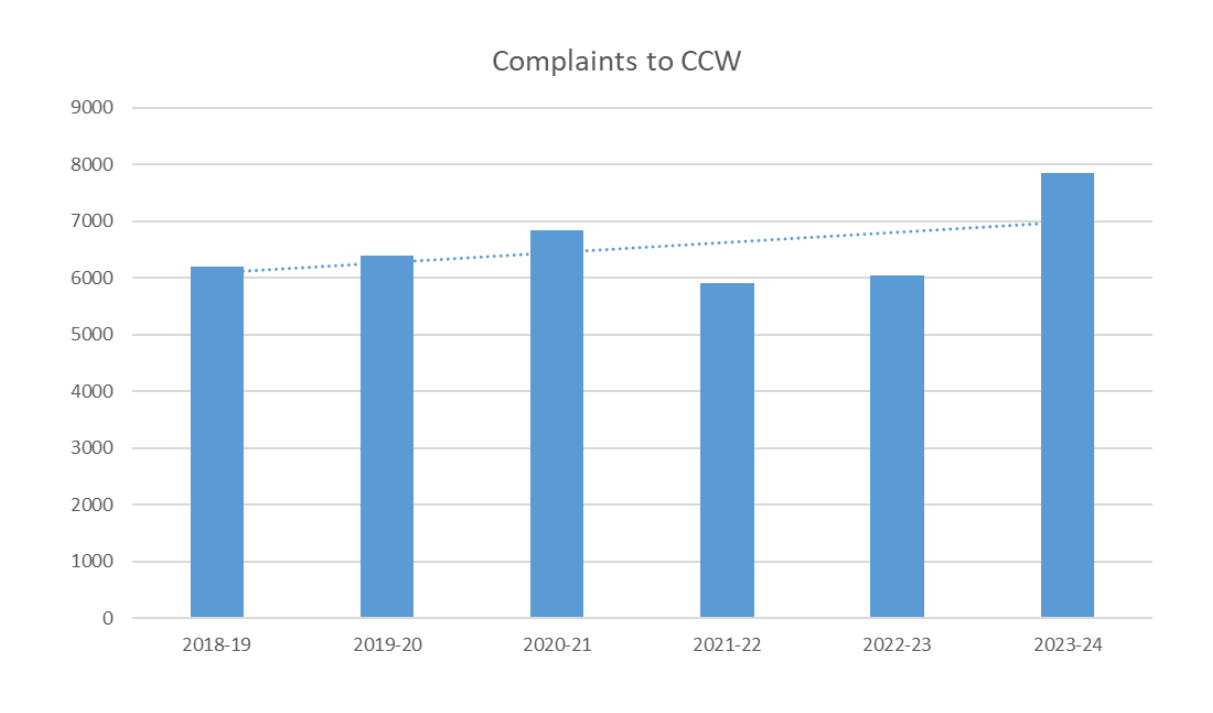

CCW has seen a continued overall increase in customer complaints over the last few years. High volumes of complaints are evidence of a poor experience for many customers and can be an indicator of more fundamental problems.

View enlarged complaints to CCW graph (png)

Measures of customer satisfaction alone may not adequately incentivise companies to resolve customer issues first time to prevent complaints and address the causes of complaints. So CCW wants to see 25% of the value of C-MeX based on a measure of the volume of complaints a company receives.

As the basis of its decision to exclude a complaints volume metric, Ofwat raises concerns in the draft determinations about the reliability of complaint data as reported by companies, However, CCW has demonstrated to Ofwat how we have delivered greater consistency in data reporting through the development of our guidance to companies and our regular assessments.

The Draft Determination also says that Ofwat has ongoing concerns about data quality across all PCs, and commits to greater scrutiny to ensure data is robust and can be trusted. We fail to see how complaints data quality represents a greater risk of data inconsistency than other data sources, and would like Ofwat to reconsider including a complaints volume metric in C-MeX. Otherwise this is a missed opportunity to address the trend of rising complaints to incentivise poor performing companies to improve, because complaint volumes can be seen as evidence of the wider decline in customers’ trust in the sector.

Alternatively, Ofwat could consider a separate performance commitment on the volume of complaints. Ofwat could signal its intention to include this from 2026 onwards in the Final Determination, if it needs time to develop targets for each company

CCW supports the introduction of a new customer experience measure to track business customer retailer satisfaction in the market in England and the business customer experience in Wales. It’s important that business customers’ experience with wholesalers in England, and water companies in Wales, is tracked so that they improve their offer. CCW’s Five-Year Review shows a lack of satisfaction among business customers.

CCW also agrees that the targets under this measure should be tailored to each individual company.

CCW recognises why Ofwat grades water companies’ business plans. However, we have previously seen many excellently graded plans not get delivered. CCW believes companies already have enough incentives through actual delivery of their plans. We want to see business plans assessed so that companies are penalised for poorly evidenced plans, rather than rewarded for the basic company responsibility to write a decent business plan. Although Ofwat has measures to claw back money if plans are not delivered, CCW does not believe there should be a financial reward taken out of bill payers’ pockets for merely writing a robust business plan.

The five-year package of investment and performance commitment targets should act as a milestone towards delivering a longer-term set of outcomes. CCW sees some evidence that these five-year determinations do contribute towards some longer-term outcomes – for example, through the allowance of development costs for long-term investment projects.

However, we cannot see to what extent the companies’ Long Term Delivery Strategies and adaptive planning has informed their decisions and the investment costs – and subsequent bill impacts for customers – that may follow in PR29.

All water companies in England made a public interest commitment to achieve net zero carbon emissions by 2030. CCW is disappointed to see that Ofwat’s draft determinations do not mention this net zero carbon target. In fact, because the draft determinations only mention carbon as percentage targets, it is impossible to see whether these targets are an appropriate milestone on the UK’s journey to net zero by 2050.

The Climate Change Committee points out in its 2024 Progress Report to Parliament that the UK is not on track to meet its 2030 nationally determined contributions as promised as part of the Paris Agreement. The interim Chair, Professor Piers Foster, is clear:

This will need to change – quickly.

Some water companies in England and Wales seem to have abandoned their 2030 commitments. That leaves all the heavy lifting to be done in PR29 and beyond. This will have higher cost implications for customers and for the environment.

Ofwat’s draft determinations lack clarity on how the two water companies operating in Wales (Dŵr Cymru and Hafren Dyfrdwy) are to meet their pledges in accordance with the Well-being of Future Generations (Wales) Act 2015.

CCW was concerned to see Ofwat’s repeated mentions of “building nine new reservoirs” in its July 2024 Sector Summary and its media messaging at the publication of the draft determinations. Reservoirs can take many years to deliver, well beyond the 2025-30 period, so customers must understand that the cost they are paying in this five-year period may only be for early development. Ofwat must be careful not to inadvertently further undermine trust in this mistrusted sector.