Business Customer Complaints 2023-24

Our annual Business Customer Complaints Report gives an overview of complaints made by business customers in the water retail market in England and Wales during 2023 to 2024.

Business customers in England have been able to choose who provides them with water retail services1 since April 2017.

This year, CCW has started to look at retailer2 performance based on both total complaints received directly by retailers and total complaints escalated to us. This is also the first year we are reporting total complaints across all of the contact channels used by retailers3. This means the data on the total number of complaints to retailers will not be comparable to previous reports, where figures were based on written complaints only.

We have made some comparisons between the number of written complaints where we felt this might help illustrate retailer performance. This is the first year we have seen written complaints to retailers fall below pre-market levels. But it remains hugely disappointing that business customer complaints to CCW increased and remain significantly above pre-market levels. CCW set a target for retailers to reduce these by 10% in 2023-2024, but overall complaints made to us about retailers actually increased by 2%.

This will be the last year that CCW looks at the number of written complaints in isolation. In future, we will only look at the total number of complaints. We have highlighted more data about billing and administrative complaints in this report so that we can work with retailers over the next year to help them improve their response in these areas and we will look at progress with this next year.

1 In April 2017, the water retail market in England was opened to businesses, charities, and public sector organisations. This allowed them to choose who provides their retail services, which cover customer service, billing, and meter readings. In Wales, only business customers who use fifty megalitres of water a year are eligible to access the retail market and choose their water retailer. Therefore, for most business customers in Wales, their retail services are still provided by the water companies Dŵr Cymru Welsh Water and Hafren Dyfrdwy.

2This report looks at the complaints that business customers in England and Wales made during 2023-24. We use the word ‘retailers’ to refer to both water companies in Wales and retail service providers in England, unless otherwise stated.

3 This includes complaints made in writing, as well as those received over the telephone and via social media.

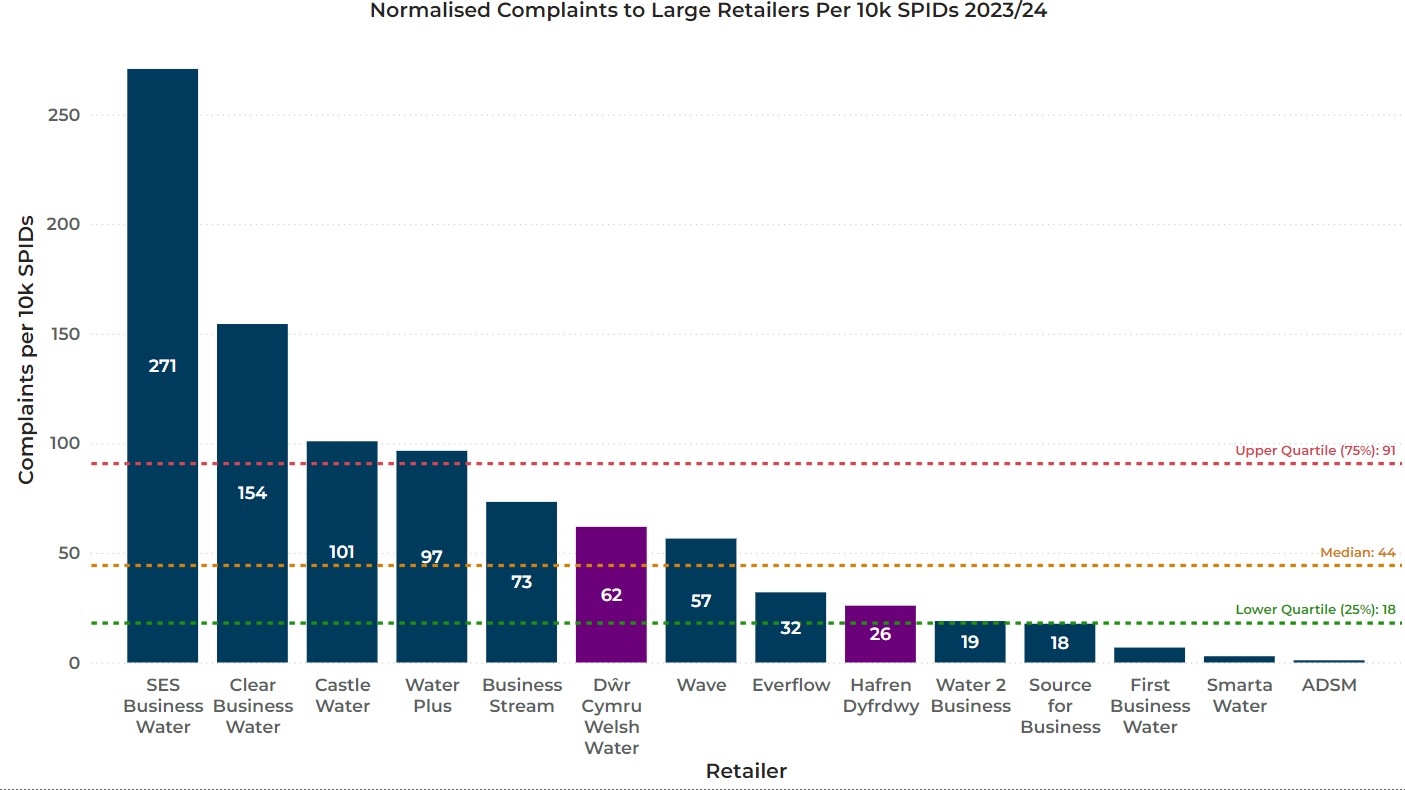

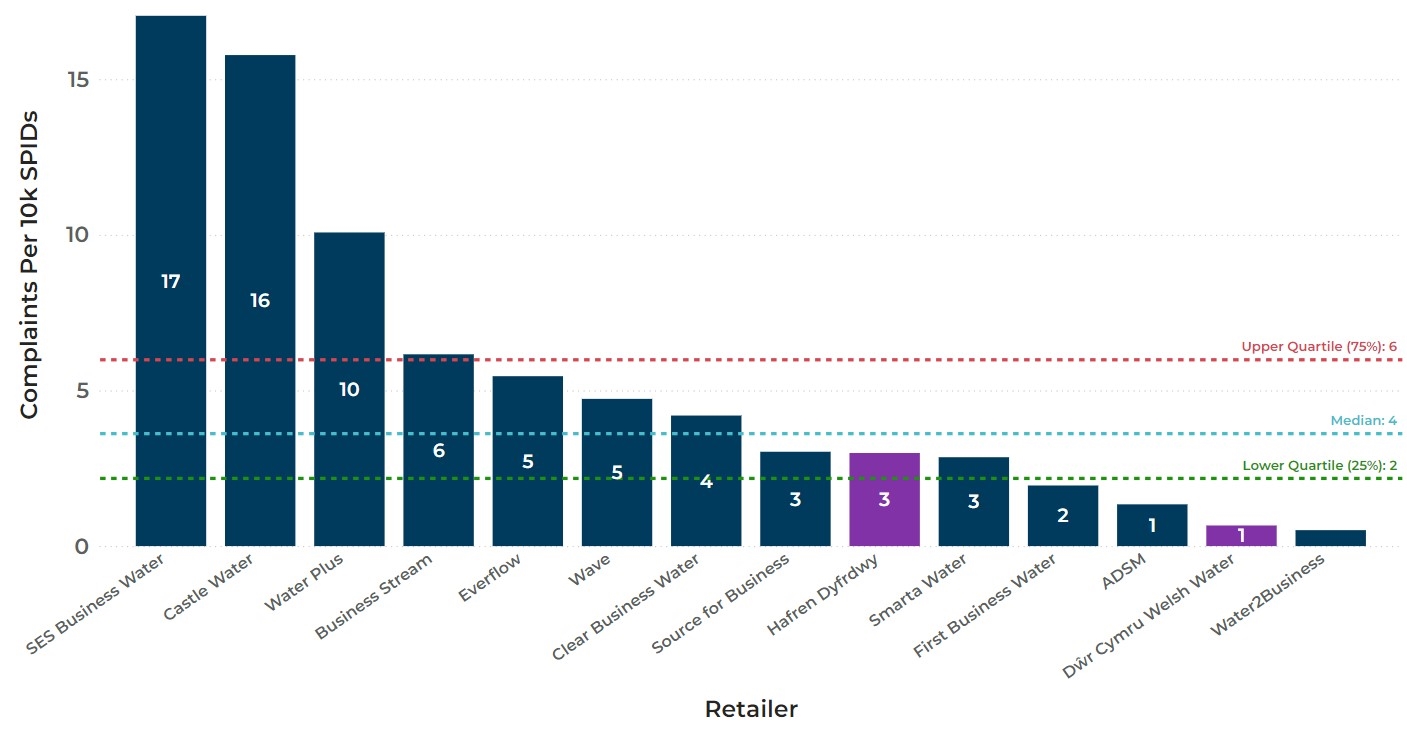

Most business customer complaints made in the period covered by this report were made to larger retailers, who each supply more than 5,000 SPIDs4. We have compared their performance using the median (mid-point) and quartiles5 calculated from the normalised submissions data supplied by retailers6.

Small retailers are defined as those with less than 5,000 SPIDs. There are four retailers in this category: ConservAqua, The Water Retail Company, Veolia Water Retail and Yu Water. Smarta Water moved into the large retailer group during 2023-24, as they now have more than 5,000 SPIDs.

In most cases, we present the complaint numbers as a figure per 10,000 connections7 – also known as supply point ID’s (SPIDs). Some smaller retailers have very small numbers of complaints. Because of this, normalising their figures can make their performance appear extreme. We therefore consider these retailers separately.

4 A Supply Point ID (SPID) is a reference number for each supply point to a business customer premises and applies only to retailers. For water companies we use connections instead of SPIDs for normalising complaints.

5 Sometimes referred to as a percentile.

6 The median is the exact mid-point of the data set (50%). The lower quartile (25%) is below the median, and the upper quartile (75%) is above the median

7 This is ‘normalising’ and enables us to make a more meaningful comparison between retailers, regardless of the size of their customer base.

As we enter the eighth year since the water retail market opened in England, the industry is increasingly recognising the need to resolve market issues that are affecting the service business customers receive and which cause complaints.

CCW’s review of ‘Business Customers’ Experience of the Water Retail Market’8 published in March 2023, set out 22 recommendations on what needs to change to improve the market for business customers. These recommendations focus on the areas that drive customer complaints, including poor data quality, inaccurate billing, and problems obtaining leakage allowances.

Since then, CCW has made significant progress delivering these recommendations by working with the industry and key stakeholders, including the water regulator, Ofwat, and MOSL, the market operator for the non-household water retail market in England and Wales.

CCW has been part of a key project to improve the accuracy of customer data that retailers and wholesalers hold. We have also contributed to a review of market incentives, including those relating to reading meters. This work will help improve required service standards.

In addition, CCW’s Five-Year Review identified other key areas that give customers cause to complain:

- poor communication and consistency around leak allowance policies and processes

- inconsistent decisions from retailers and wholesalers on whether a customer should be in the retail market.

We will continue to work on improving these during 2024-25 and delivering our recommended changes.

Customer complaints data provides crucial evidence for CCW’s work with retailers to improve their services and standards. We work with retailers to address business customers’ concerns and help improve the service.

Every two years, CCW carries out Testing the Waters tracking research which looks at how business customers in England and Wales feel about the water, sewerage, and retail services they receive. The last report was published in January 2023, and we will publish the next report in January 2025. We use the evidence and insight from this research to support our representations to retailers.

8 Referred to in this report as the ‘Five-Year Review’

4.1 Overview

There were 20,744 complaints from business customers to retailers across all contact channels in 2023-24, averaging at 75 complaints per 10,000 SPIDs. The breakdown between retailers is shown in Figure 1.

Figure 1: Complaints made through all channels to large retailers per 10,000 SPIDs in 2023-24 (Welsh companies highlighted in purple)

View full size image of figure 1 (jpg)

Table 1: Complaints to small retailers 2023-24

| Retailer | Total number of complaints |

|---|---|

| ConservAqua | 0 |

| The Water Retail Company | 0 |

| Veolia Water Retail | 0 |

| Yu Water | 5 |

| Total | 5 |

Table 1 compares to 14 complaints that were received in 2022-23 – 1 from Smarta Water (now a large retailer) and 13 from Yu Water. In 2023-24, all complaints to small retailers were about Yu Water but this retailer has decreased its complaints by 62% compared to last year.

4.2. Looking at the trends in complaints to retailers

4.2.1 Written complaints to retailers fall below pre-market level

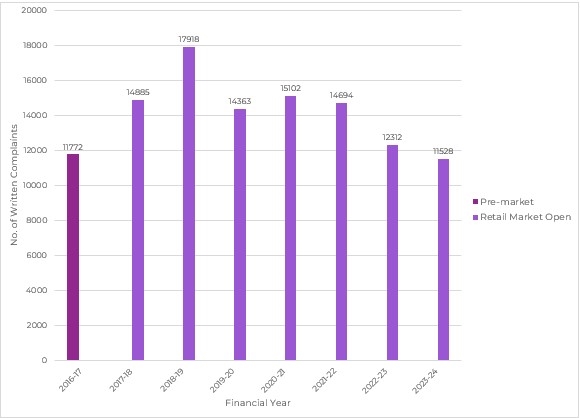

As previously mentioned, large retailers received 20,744 complaints across all contact channels. Since this is the first year of collecting this range of data, we have no figures to compare this to. However, to give us a sense of progress and to enable us to compare performance, we have separately reported on written-only complaints.

11,528 complaints were written, while 9,221 were made through other channels, including telephone and social media.

Figure 2: Total written-only complaints to retailers in 2023-24

View full size image of figure 2 (jpg)

This figure is a reduction of 6% on the number of complaints in 2022-23 and 2% lower than the pre-market figure. In 2016-17, before the market opened, there were 11,772 complaints.

We would like to be cautiously optimistic about these figures, but we currently have no real sense of whether these reductions are because customers are turning to other channels, such as telephone or social media, to make their complaints. We will be able to assess whether retailers have made consistent progress in reducing the overall number of complaints next year, when we have two years of data on other channels of complaints. Table 2 shows total complaints to retailers.

Table 2: Total complaints to large and small retailers per 10,000 SPIDs in 2023-24

| Key |

|---|

| Red = Poorer performers |

| Amber = Worse than the median |

| Yellow = Better than the median |

| Green = Better performers |

| Welsh retailers |

Complaints to large retailers 2023-24

| Retailer | Number of complaints to retailers | Per 10k SPIDs |

|---|---|---|

| SES Business Water | 1049 | 271 |

| Clear Business Water | 405 | 154 |

| Castle Water | 4977 | 101 |

| Water Plus | 6881 | 97 |

| Business Stream | 2878 | 73 |

| Dŵr Cymru Welsh Water | 1214 | 62 |

| Wave | 2223 | 57 |

| Everflow | 475 | 32 |

| Hafren Dyfrdwy | 26 | 26 |

| Water 2 Business | 332 | 19 |

| Source for Business | 274 | 18 |

| First Business Water | 7 | 7 |

| Smarta Water | 2 | 3 |

| ADSM | 1 | 1 |

| Total | 20744 | 75 |

| Median (50%) | 440 | 44 |

| Upper (75%) | 1971 | 91 |

| Lower (25%) | 88 | 18 |

Complaints to small retailers 2023-24

All complaints received were written.

| Retailer | Number of complaints to retailers | Per 10k SPIDs |

|---|---|---|

| Yu Water | 5 | 41 |

| ConservAqua | 0 | 0 |

| The Water Retail Company | 0 | 0 |

| Veolia Water Retail | 0 | 0 |

| Total | 5 | 9 |

| All retailers total | 20749 | 75 |

4.2.2 Why are business customers making complaints?

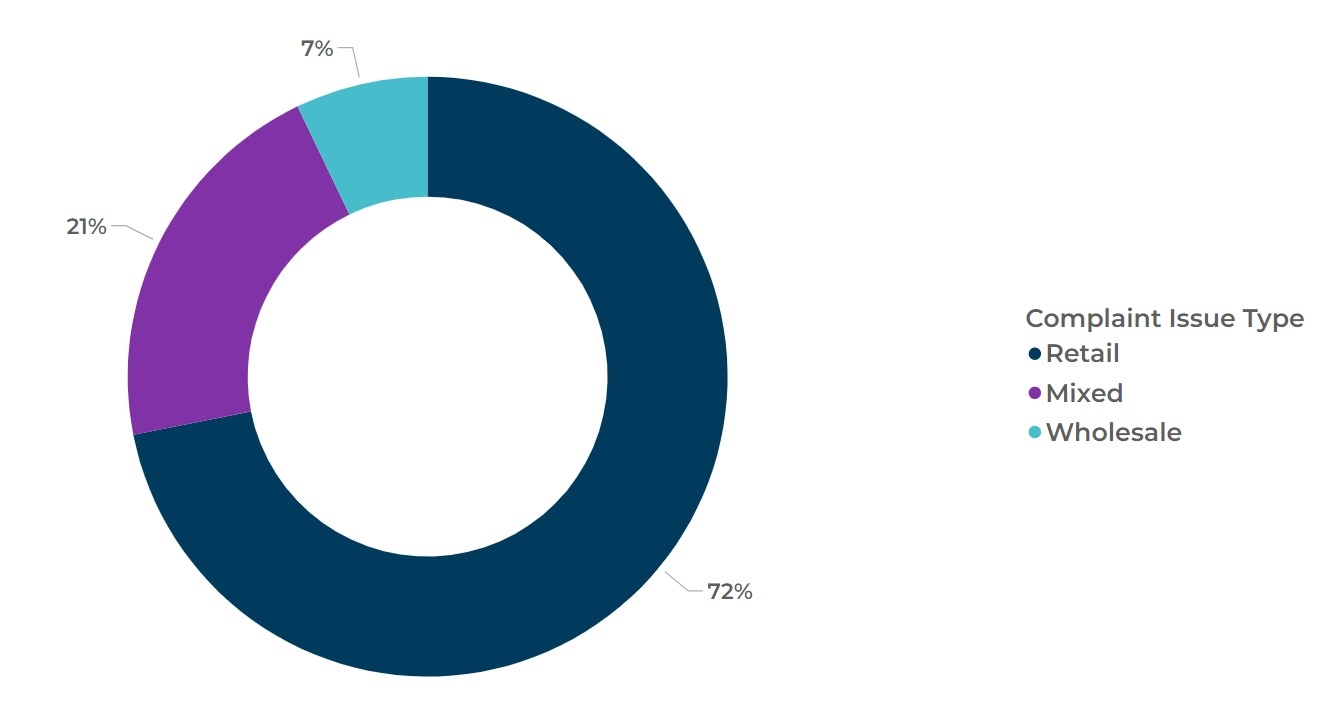

We can see from figure 3 below that nearly three quarters of business customers’ complaints relate to retail complaint issues, covering billing, metering, and customer service. 28% of all complaints are either fully or partially caused by the wholesalers. Both retailers and wholesalers have a key role in preventing and resolving complaints and CCW will continue to work with both parties, on an individual company basis and through our forums, to encourage better collaboration.

Figure 3: Complaints to retailers broken down by retail/wholesale/mixed complaint issue type as a percentage in 2023-24

View full size image of figure 3 (jpg)

4.2.3 Complaints to retailers by contact channel

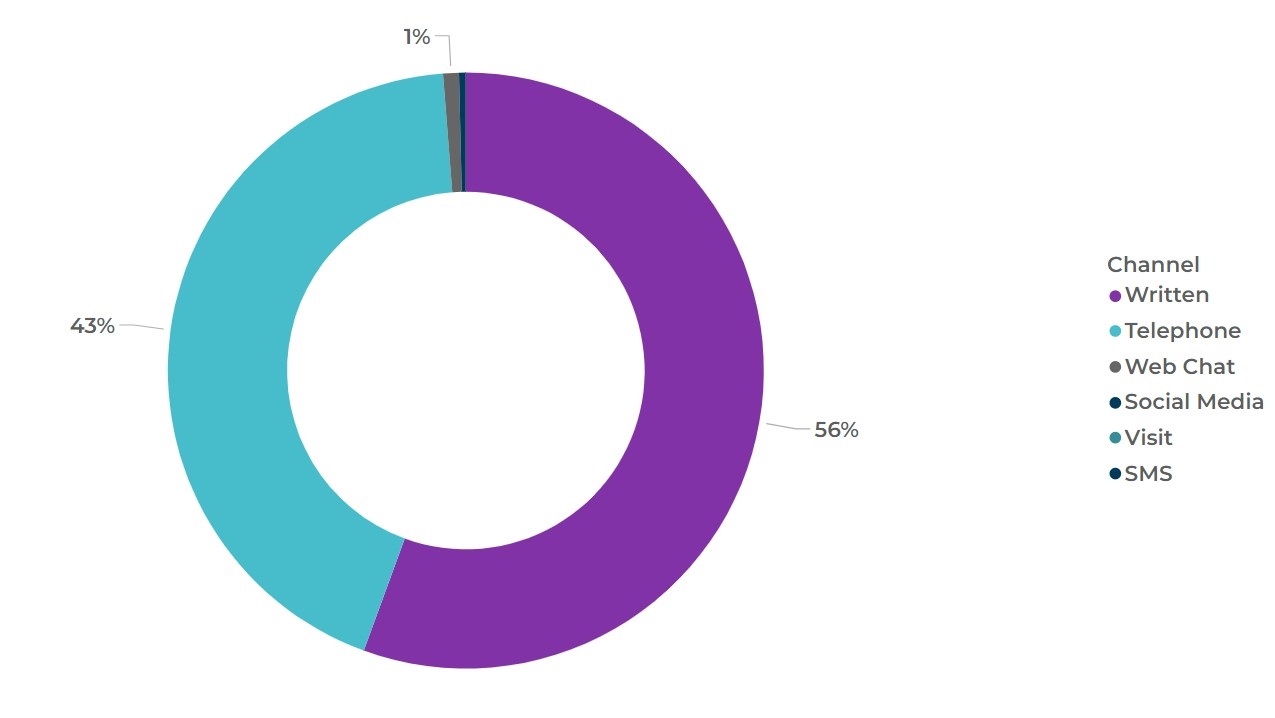

Figure 4 looks at how customers are making their complaints. The figures reflect how customers prefer to contact the retailers, ease of the different methods of contact and the contact channel mainly used by the retailer.

Figure 4: Complaints to retailers by contact channel in 2023-24

View full size image of figure 4 (jpg)

Web chat accounts for just under 1% of complaints, while social media and visits account for less than 0.5% of all complaints. Visit complaints are defined as those where a customer attends the retailer’s office in person to raise a complaint. No complaints were received by SMS.

4.2.4 Complaints to retailers by complaint category

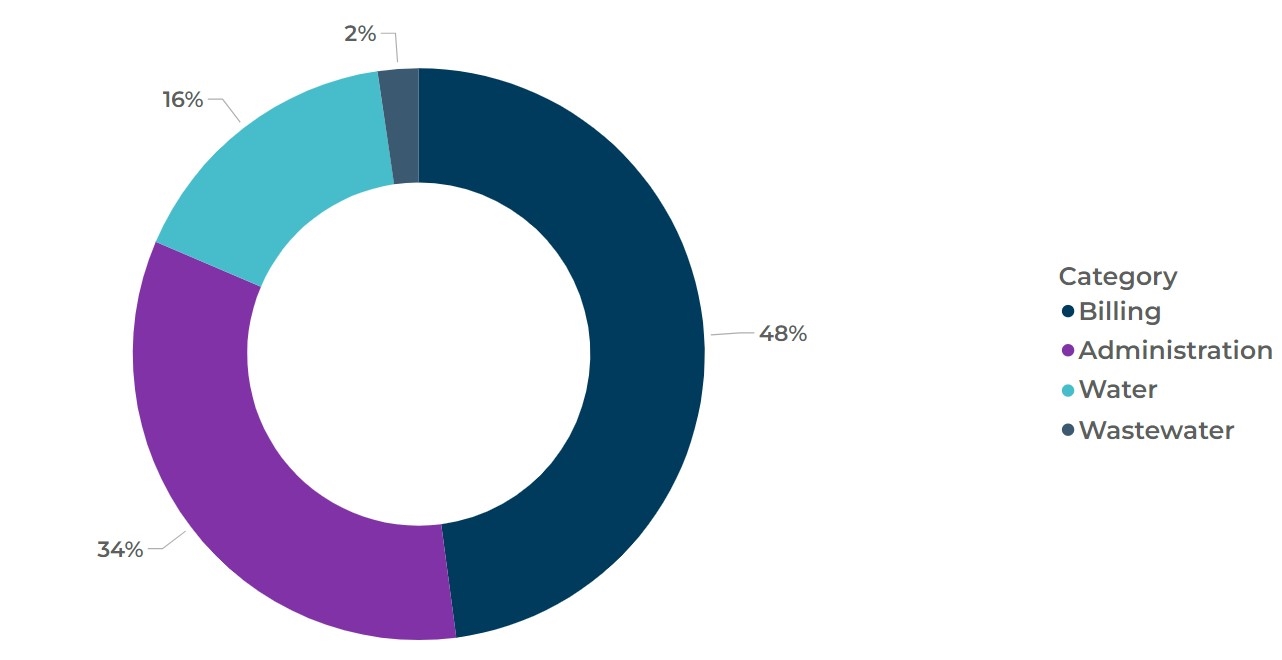

Figure 5: Complaints to retailers by complaint category in 2023-24

View full size image of figure 5 (jpg)

Billing issues were the biggest cause of complaints again this year, accounting for 48% of all complaints to retailers. Bills can be inaccurate if meters are not read for a long time, or they need repairing or replacing. Both retailers and wholesalers have responsibilities here, and CCW continues to encourage them to work together to read meters and resolve metering problems as quickly as possible. Following on from our Five-Year Review, we also continue to play an integral role in industry work to improve the quality of customer data, and ensure retailers and wholesalers are being properly held to account for poor performance.

Complaints about administration account for a significant percentage (34%) of total complaints to retailers. If retailers and wholesalers hold inaccurate or incomplete customer information (e.g. customer address or property reference number), this can cause complaints. CCW’s Five-Year Review identified problems in this area, so, as part of MOSL’s data assurance project group, we input to help water companies improve the information they hold.

CCW will continue to work with all retailers to improve complaints performance. We will do this through meetings, including our Retail Market Forums and other forums aimed at improving retailer and wholesaler communication. We are also piloting complaints assessments for retailers over the current year. This will give retailers an in-depth assessment of how well they handle their complaints and how we can work together to improve processes for the benefit of business customers.

5.1 Overview

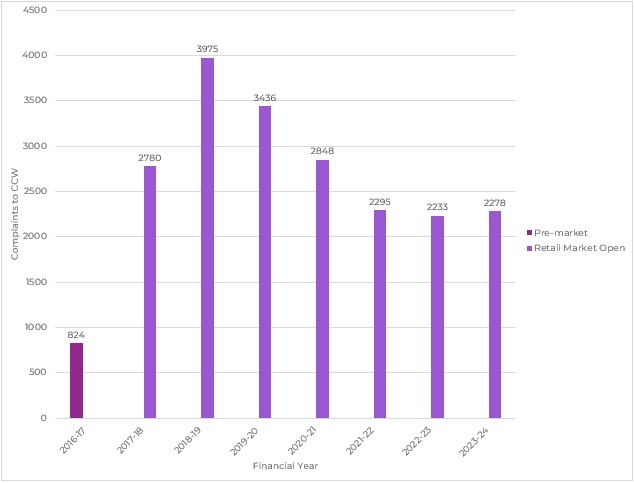

Business customer complaints to CCW were significantly higher than pre-market levels. We set a target for retailers to reduce these by 10% in 2023-24, so it is really disappointing that overall complaints made to us about retailers increased by 2%.

Figure 6 below shows that before this year, there had been a slight but continuous year-on-year improvement since 2019-20, which had slowed over the last three years.

However, when compared to pre-market figures complaints to CCW increased by 1,454 in 2023-24. This is an increase of 176% since 2016-17.

There were 2,278 complaints – or 8 complaints per 10,000 SPIDs – from business customers to CCW about retailers in 2023-24.

Figure 6: Total complaints to CCW in 2023-24 (including ‘Other’ unattributed complaints)

View full size image of figure 6 (jpg)

Figure 7: Complaints to CCW about large retailers per 10,000 SPIDs in 2023-24

View full size image of figure 7 (jpg)

In 2023-24, CCW received around10% of the total number of complaints that retailers received.

Of the total 2,161 complaints directly assigned to a retailer only 2 of them were about small retailers:

Table 3: Complaints to CCW about small retailers in 2023-24

| Retailer | Number of complaints | Per 10k SPIDs |

| ConservAqua | 0 | 0 |

| The Water Retail Company | 0 | 0 |

| Veolia Water Retail | 0 | 0 |

| Yu Water | 2 | 17 |

| Total | 2 | 3 |

5.2 Complaints to CCW by category

5.2.1 Overview

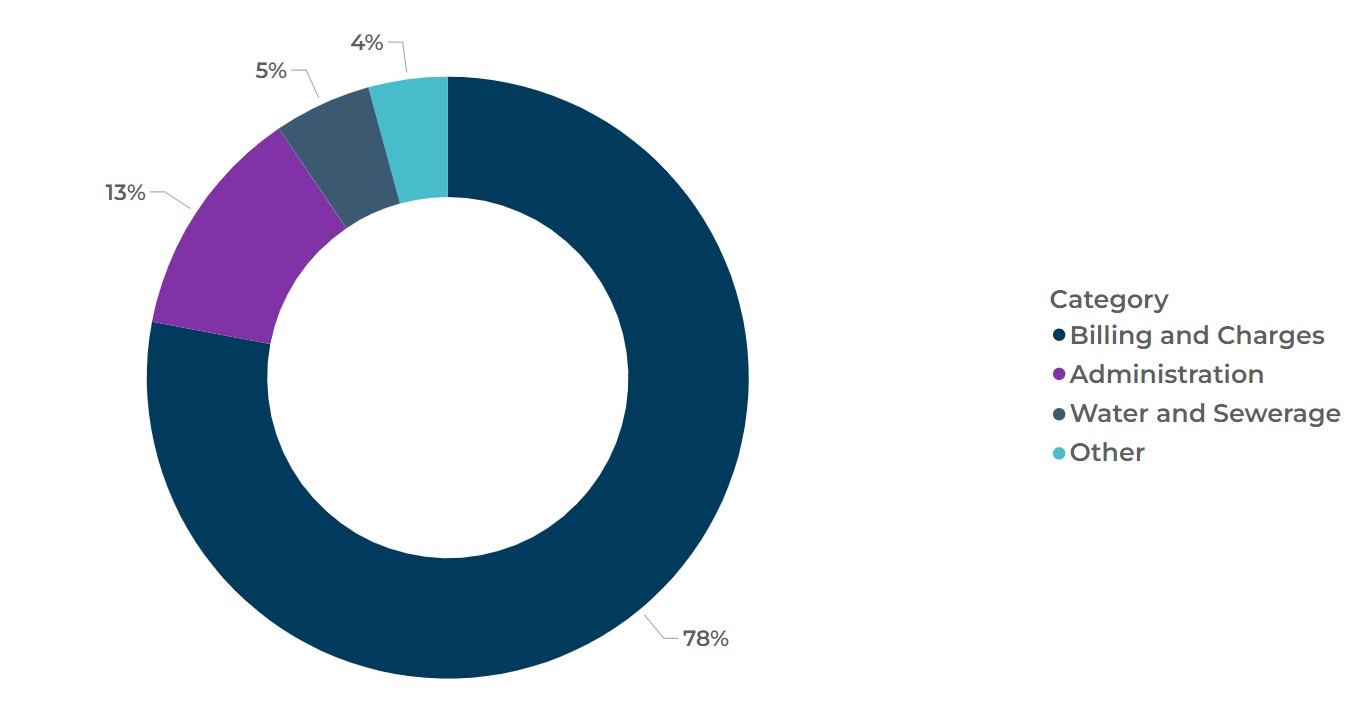

Figure 8: Complaints to CCW by complaint category in 2023-24

View full size image of figure 8 (jpg)

Figure 8 shows how complaints about billing and charges formed the majority of complaints to CCW. We look at this further in the next section.

5.2.2 Billing and charges complaints to CCW

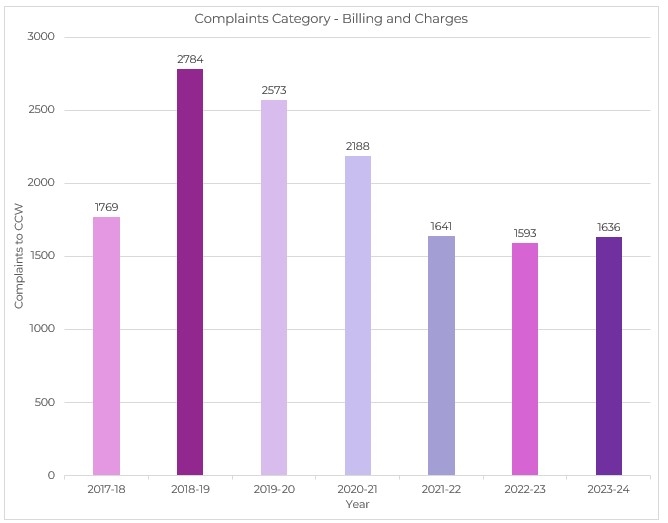

There were 1,636 Billing and Charges complaints to CCW in 2023-24. This is an increase of 3% on 2022-23.

Figure 9: Total billing and charges complaints to CCW since 2017-18

View full size image of figure 9 (jpg)

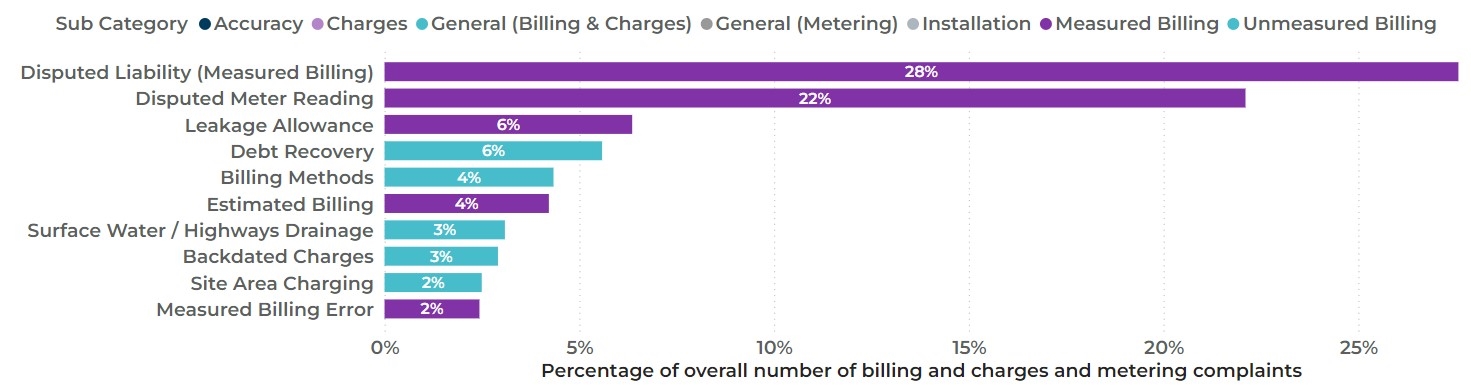

To understand what causes complaints about billing and charges, we looked at these figures further. Of the top 10 root causes of billing and charges complaints 62% of these related to measured billing, including disputed liability for metered bills, disputed meter reading and leakage allowance. We look at leakage allowance in section 6.1.

Figure 10: Reasons for complaints to CCW about billing and charges in 2023-24

View full size image of figure 10 (jpg)

The reasons in figure 10 cover services provided by both the retailer and wholesaler. The complaint sub-categories that may be driven by wholesaler actions include leakage allowances, site area charging and surface water/highway drainage.

Complaints about disputed liability (where customers challenge the amount of water they have been charged for) continue to be a main reason customers contact CCW. A key cause of this is that meters are not being read as frequently as they should, and customers are billed on estimates. The proportion of meters that have not been read for over a year (commonly called long unread meters) has decreased by 2% during 2023-24, with the overall number of meters that are long unread now standing at 12%.

Retailers are responsible for reading their customers’ meters, so CCW expects them to continue addressing long unread meters to improve billing accuracy. This would help to reduce the number of complaints in this area. We continue to work with MOSL and the industry to make changes to the service standards that retailers must meet in this area. In December 2023, we asked Ofwat to change the Customer Protection Code of Practice, so that retailers have to bill customers based on two meter reads per year.

We recognise the role that wholesalers have to play in this area, too. We have helped to shape the National Metering Strategy (pdf), published in March 2024. One of the recommendations, which aligns with our views, is that retailers should install smart meters where meters have been left unread for more than 12 months. This should ensure that the charges more accurately reflect a customer’s water usage and help to drive down complaints on this issue. We also continue to work with the industry on how the data from smart meters can be made available to retailers and customers in a consistent and understandable format.

26% of complaints about billing and charges were about general issues. These can vary from customers complaining about payment methods, payment charges, debt recovery processes and their negative impact on a customer’s credit file.

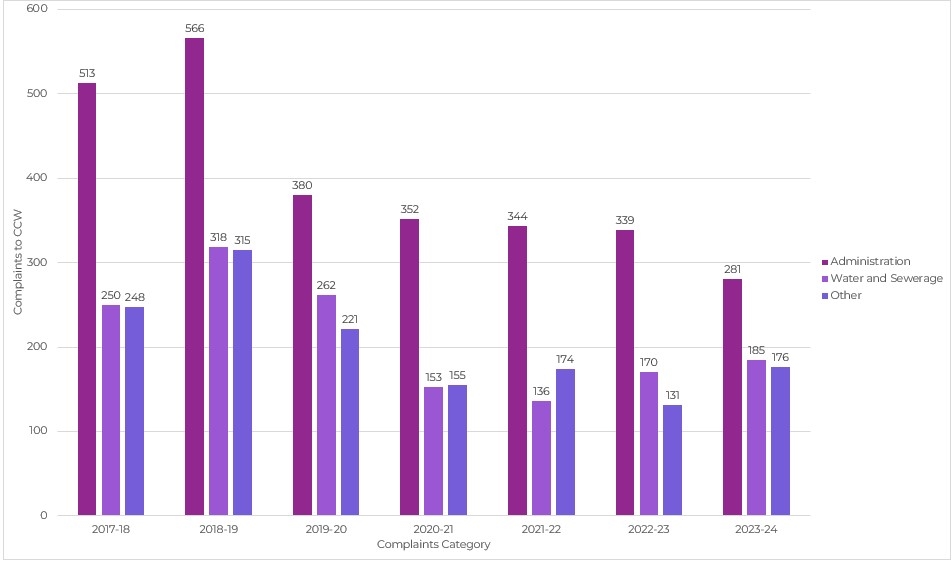

As well as complaints about billing and charges, around a quarter of the complaints are about other issues.

Figure 11: Total non-billing and charges complaints to CCW in 2023-24

View full size image of figure 11 (jpg)

Administration complaints include contact about incorrect account details and where business customers cannot get through to their retailer and these fell by 17%.

Water and sewerage complaints relate to the water and sewerage services being provided and these increased by 9%.

Complaints designated as ‘Other’ include those made about meter installation, location and whether the meter is working properly, and environmental issues, such as sewage pollution, as well as non-regulatory complaints, like being unhappy with the website of the water company or water resale complaints. These increased by 34% in 2023-24 compared to the previous year.

‘Other’ also includes complaints about retail competition, which cover how the water retail market works and includes complaints around contracts, eligibility for the market, marketing, and errors in switching retailer.

We look further at these three categories in the next sections.

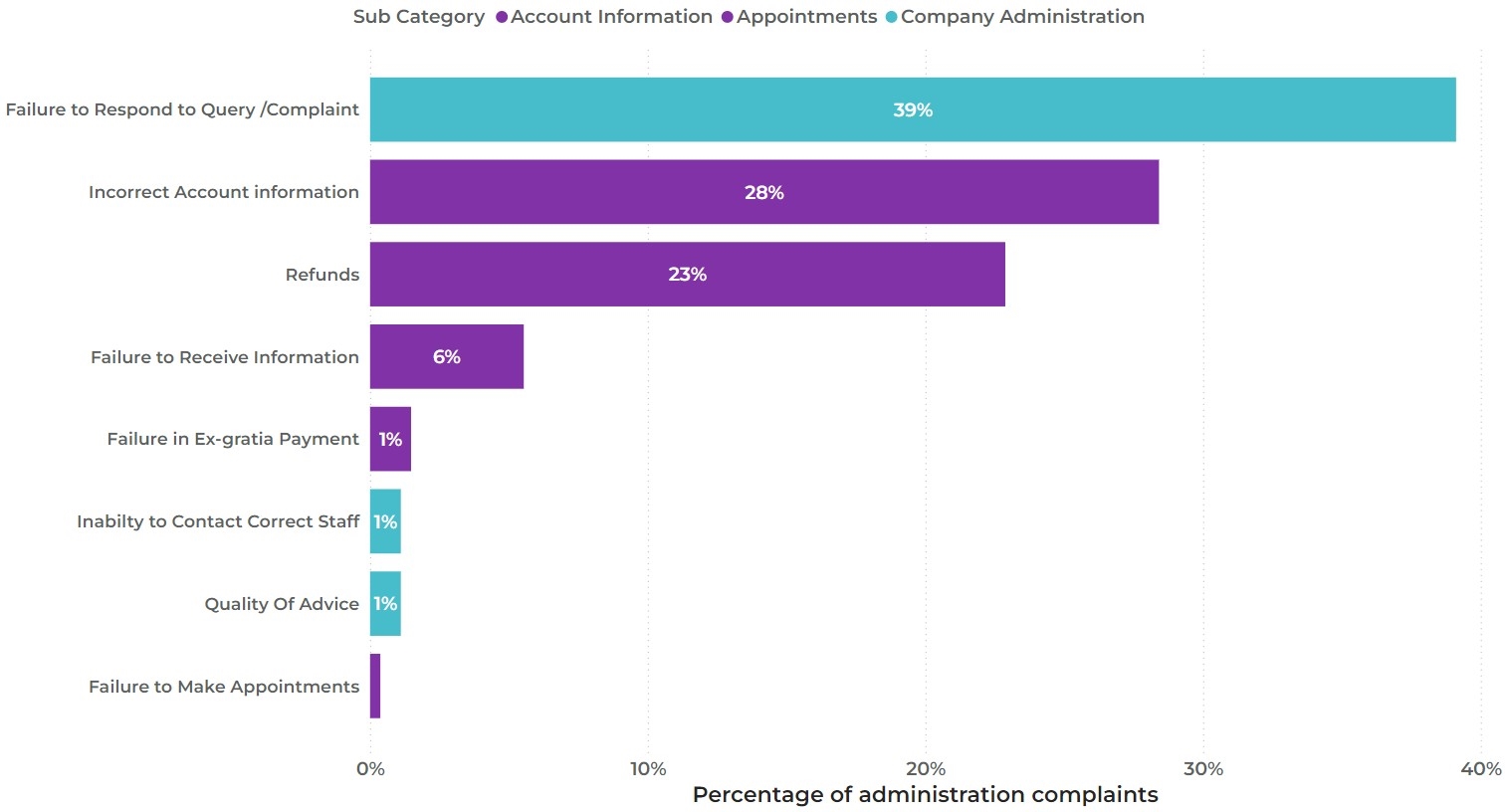

5.2.3 Administration complaints to CCW

Figure 12: Administration complaints to CCW in 2023-24 by root cause

View full size image of figure 12 (jpg)

39% of complaints about administration were caused by retailers failing to respond to a query or complaint. After this, incorrect account information (28%) and refunds (23%) are the second and third biggest root causes.

Following on from our Five-Year Review, we have been involved in MOSL’s data assurance project which is helping retailers and wholesalers identify and rectify incorrect customer data. While this project remains on-going, we are positive about the progress made so far, and hope to see improvements translate into a reduction in administration related complaints from business customers.

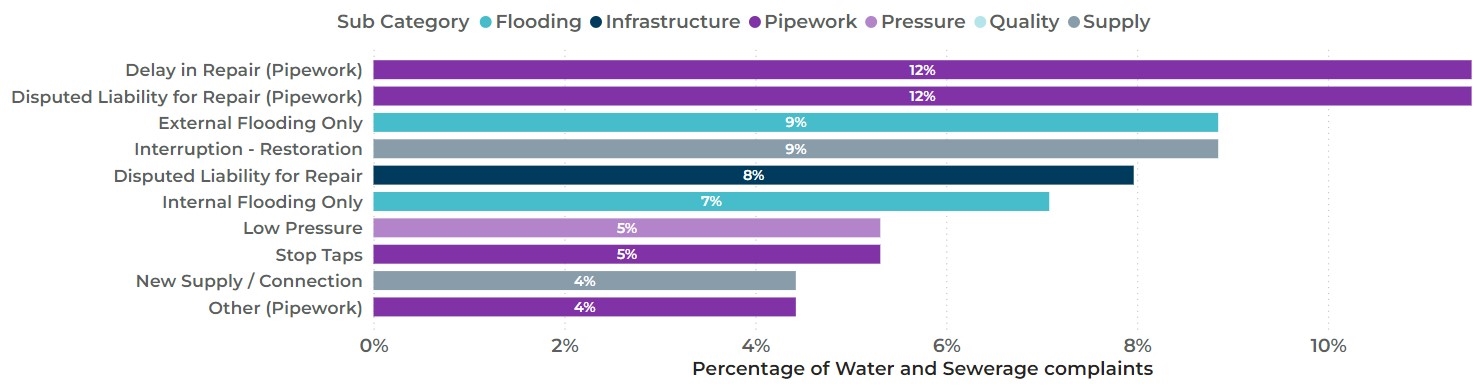

5.2.4 Water and sewerage service complaints to CCW

Figure 13: Water and Sewerage service complaints to CCW in 2023-24

View full size image of figure 13 (jpg)

The top two causes of complaints about water and sewerage services related to pipework – delay in repairing it or disputed liability for repair9. CCW has already worked with companies to address some of these issues. For example, we have worked with companies to improve how they support customers when they have sewer flooding. CCW’s current campaign on the guaranteed standards scheme (GSS) has recommended that the maximum payment for external flooding for businesses is increased from its current level.

9% of complaints are caused by issues with the restoration of supply after an outage. There are lessons for the non-household market to learn from CCW’s joint research with Ofwat into the experiences of household customers during supply interruption incidents. This is an area where wholesalers can significantly improve their response. Wholesalers and retailers must work closely together during incidents impacting business customers.

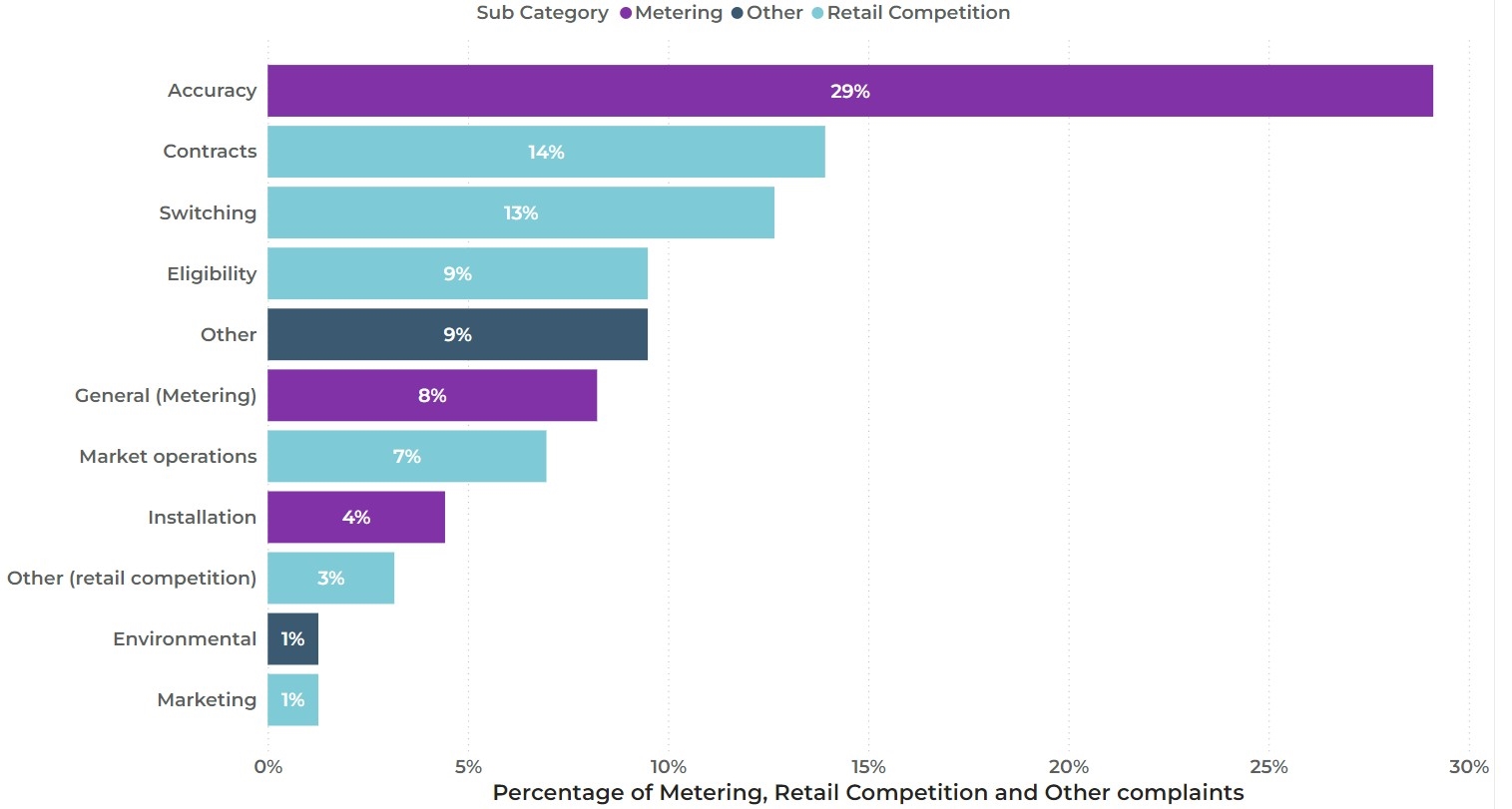

5.2.5 Other complaints to CCW

Figure 14: Causes of ‘Other’ complaints to CCW in 2023-24

View full size image of figure 14 (jpg)

In Figure 14, complaints designated as ‘other’ mostly relate to issues around metering (41%), and retail competition (47%).

How well the meter is working is the largest root cause of metering complaints (29%). This is when a customer disagrees with whether the meter is working correctly and has recorded the right usage.

The second and third largest causes of complaint are water supply contracts (14%) and switching water supplies (13%). This year, business customers complaining about their contracts were mostly concerned with the contract being agreed by an unauthorised person or tariff changes.

The main reasons why business customers complain about switching contracts are when transfers are made without their consent, or retailers block their requests to switch. In addition, some business customers are still disputing whether they should be in the retail market.

Customers are often unhappy with, or confused about, the decision that has been made by retailers and wholesalers about their eligibility for the market (9%). This can be due to inconsistent interpretations of Ofwat’s eligibility guidance, which sets out which non-household customers in England and Wales can switch their retailer.

CCW highlighted this problem in our Five-Year Review, and throughout the year we have been gathering further evidence on which parts of Ofwat’s guidance are not working for business customers, retailers, and wholesalers. Clearer and more simplified guidance should help customers understand why decisions have been made and help to reduce complaints. Based on evidence CCW has gathered, we are developing a proposal for revising the guidance and we will submit this to Ofwat.

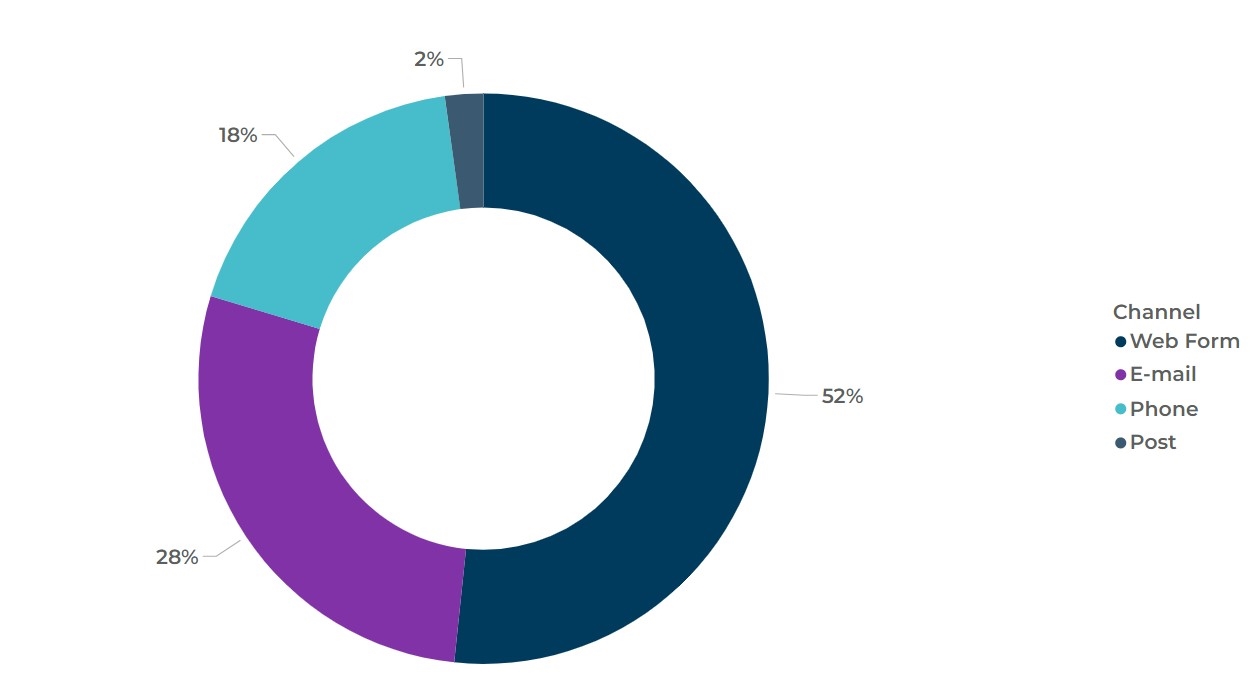

5.3 Complaints to CCW by Channel

Figure 15 shows the methods that customers used to contact CCW with their complaints.

Figure 15: Complaints to CCW in 2023-24 by complaint channel

View full size image of figure 15 (jpg)

6.1 Leakage allowance complaints to retailers

In some circumstances, business customers may be granted a leakage allowance to cover the cost of water lost due to a leak. In the business retail market, the wholesaler sets the policy and provides the allowance, where applicable. Retailers are responsible for explaining the wholesaler’s policy to the customer and arranging the allowance application on their behalf. If allowances are not granted, it can result in complaints.

Table 4: Leakage allowance complaints to retailers (excluding Welsh companies) across all contact channels in 2023-24

| Retailer | Number of leakage allowance complaints (all channels) | % of total complaints to retailer |

|---|---|---|

| Water Plus | 422 | 6% |

| Castle Water | 254 | 5% |

| Business Stream | 253 | 9% |

| Wave | 99 | 4% |

| Source for Business | 92 | 34% |

| Everflow | 38 | 8% |

| SES Business Water | 31 | 3% |

| Clear Business Water | 24 | 6% |

| Water 2 Business | 15 | 5% |

| ADSM | 1 | 100% |

| Total | 1229 | Not applicable |

While the overall percentage of leakage allowance complaints is relatively low, at 6%, these tend to be protracted and can have a particularly adverse financial impact on customers. This is the second year we have collected information from retailers to help understand what causes the problems.

Complaints can arise when business customers raise concerns about how the retailer handles their leakage allowance application, or where they feel that the wholesaler did not take all the circumstances into account when deciding on the allowance. Many complaints about this tend to be generated by the wholesaler’s activity, including its decision on whether to grant the allowance. Not all water companies offer a leakage allowance and this can affect the number of complaints received by retailers. One retailer impacted in this way is Source for Business, with leakage allowance complaints being 34% of its total complaints in 2023-24.

CCW’s Five-Year Review called for greater customer focus from wholesalers in this area. In 2023-24, we asked for leakage allowance policies to be customer friendly and readily accessible on wholesalers’ websites, to help retailers and customers better understand their rights and responsibilities. We are continuing to work with both wholesalers and retailers to improve policies and communication in this area in 2024-25. We hope this will lead to a decline in complaints to retailers and to CCW about leakage allowances.

6.2 Stage 2 complaints to retailers

Since last year’s report, CCW has collected information on how many complaints to retailers were not resolved at the first opportunity and were then escalated to the next stage of the company process – known as Stage 2 complaints. Stage 2 complaints are a clear indicator that retailers could improve how they handle complaints at Stage 1, to avoid the customer having to complain again.

This data shows Water Plus, Castle Water and SES Business Water have the highest number of stage 2 complaints per 10,000 SPIDS, and Water 2 Business has the lowest number.

Table 5: Stage 2 complaints to retailers in 2023-24 by retailer per 10,000 SPIDs

| Retailer | Stage 2 complaints to companies | Complaints per 10k SPIDs |

|---|---|---|

| Water Plus | 941 | 13.21 |

| Castle Water | 359 | 7.28 |

| Wave | 94 | 2.39 |

| Dŵr Cymru Welsh Water | 71 | 3.62 |

| Source for Business | 33 | 2.13 |

| Everflow | 25 | 1.68 |

| SES Business Water | 23 | 5.94 |

| Water 2 Business | 8 | 0.46 |

| Clear Business Water | 8 | 3.05 |

| Total | 1468 | Not applicable |

6.3 Alternative Dispute Resolution (ADR)

If a customer is unable to resolve their dispute with their retailer, they can go through an independent ADR provider for adjudication without needing to go to court. CCW asks each retailer to report on the number of ADR referrals that were made to their respective scheme. In 2023-24 referrals decreased slightly by 1%, from 94 to 93.

Table 6: ADR referrals in 2023-24 by retailer (from retailer submissions)

| Retailer | ADR referrals 2023/24 |

| Water Plus | 77 |

| Castle Water | 10 |

| SES Business Water | 2 |

| Source for Business | 2 |

| Wave | 2 |

| Total | 93 |

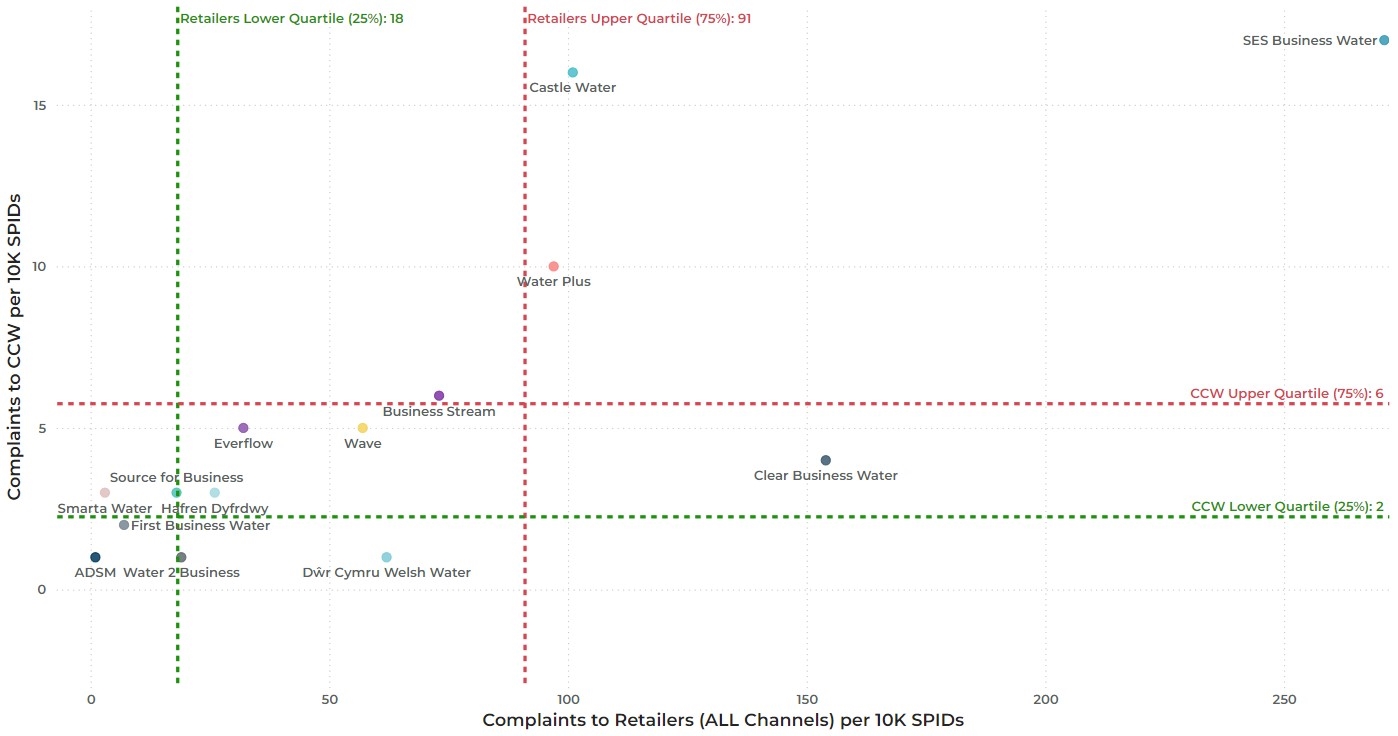

As with previous reports, CCW has looked at how retailer performance compares across the industry. To do this, we calculate quartiles to classify who is a ‘Better’ or ‘Poorer’ retail performer.

We have colour coded four categories. The better performers, with lower complaint numbers, are shown as green. The poorer performers are shown as red. Between these two points, yellow shows the retailers that are better than median while amber shows those worse than median.

We show the number of complaints to retailers per 10,000 SPIDs in Table 2. Table 7 below shows the number of complaints to CCW per 10,000 SPIDs.

Table 7: Complaints to CCW in 2023-24

| Key |

|---|

| Red = Poorer performers |

| Amber = Worse than the median |

| Yellow = Better than the median |

| Green = Better performers |

| Welsh retailers |

| Retailer | Number of complaints to CCW | Per 10k SPIDs |

|---|---|---|

| SES Business Water | 66 | 17 |

| Castle Water | 778 | 16 |

| Water Plus | 718 | 10 |

| Business Stream | 242 | 6 |

| Wave | 186 | 5 |

| Everflow | 81 | 5 |

| Clear Business Water | 11 | 4 |

| Source for Water | 47 | 3 |

| Hafren Dyfrdwy | 3 | 3 |

| Smarta Water | 2 | 3 |

| First Business Water | 2 | 2 |

| Dŵr Cymru Welsh Water | 13 | 1 |

| Water 2 Business | 9 | 1 |

| ADSM | 1 | 1 |

| Total | 2159 | 8 |

| Median (50%) | 30 | 4 |

| Upper (75%) | 160 | 6 |

| Lower (25%) | 5 | 2 |

Poorer Performers

SES Business Water: A backlog of legacy billing issues, resulting from the retailer taking on customers not previously being billed in the market (known as gap sites), continues to drive a high level of contact from customers across all channels, both to SES Business Water and to CCW. SES Business Water is engaging with CCW on its progress in this area and has forecasted performance to improve in 2024-25. CCW will continue to monitor SES Business’ performance closely, and work with them to resolve complaints when their customers reach out to CCW.

Castle Water: Castle Water remains a poorer performer both in terms of complaints to them and to CCW. Similar to last year, the retailer struggled to address high numbers of contacts from customers with relatively simple queries, which can lead to complaints if not answered promptly. To address this, the company continues to take steps to try and reduce the customer contacts it receives via telephone and email, by improving the availability of alternative contact channels. In addition, wholesaler delays in responding to the retailer’s requests to repair or replace meters, and the provision of general information, continue to drive complaints. Castle Water continues to work closely with its wholesalers to reduce the backlog in this area.

Water Plus: Water Plus remains a poorer performer, but it has shown a notable improvement by reducing the number of complaints received in the second half of the year. At the start of the year, Water Plus’ complaints increased because of changes to wholesalers’ charges. This led to customers contacting Water Plus because they were unhappy with the changes or uncertain what they meant. For example, both of Water Plus’ main wholesalers changed how they reflected non-return to sewer allowances in wastewater charges. This only changed the way customers were charged, not the amount they paid. Similarly, Water Plus started showing its retail charge separately on bills for the first time, which some customers misinterpreted as a new cost, leading to complaints. However, Water Plus has changed several of its complaint handling processes, which may be positively impacting the number of complaints received in the second part of 2023-24.

Better Performers

ADSM: ADSM have only had 1 complaint to CCW and 1 to the retailer this year.

First Business Water: First Business Water continue to be one of the best performers both in terms of complaints to retailers and those to CCW. It works with its customers to address any contact received to reduce customer complaints.

Water2Business: This retailer is one of the best performers, both in terms of complaints to retailers and those to CCW. A focus on keeping customers frequently updated while issues and requests are pending resolution, has resulted in its performance being firmly in the best performing quartile.

Smarta: Smarta has only had 2 complaints to CCW and 2 directly to the retailer this year.

Source for Business: This retailer works to address any issues at first contact by its customers and is a good performer regarding complaints to CCW and better than average for direct complaints.

Figure 16: Complaints from all channels to retailers plotted against complaints from all channels to CCW in 2023/24 per 10,000 SPID

View full size image of figure 17 (jpg)

In figure 16, the better performers are seen in the bottom left corner, and poorer performers in the top right. This also helps to illustrate the spread of retailers’ performance across both of our metrics.

As this is a transition year for reporting, CCW cannot compare this year’s figures to previous years in all categories, but we have identified some clear areas of focus.

Retailers still need to address how they tackle complaints about billing and charges. To help reduce the number of complaints, retailers should provide clear and accurate information to customers about what they are being charged for, especially in what is an increasingly difficult financial climate for both retailers and business customers. In particular, we want to see more frequent and accurate bills based on meter readings.

Wholesalers can also do more to reduce complaints, given the pivotal role they play in maintaining meters, making decisions about leakage allowances, and providing water and sewerage services. CCW will continue to work with them and retailers to improve how they work together and remain involved in industry work to improve wholesalers’ accountability for the areas they are responsible for.

As wholesalers install more smart meters for business customers, we would expect this to increase the number of bills based on actual water use rather than estimated readings. This could reduce the number of complaints, but retailers will need to work with wholesalers during this process, so customers know what to expect from a smart meter. Retailers will need to communicate clearly with customers, ahead of, during and after the installation. If they can give business customers easy-to-access information about their water usage, this will improve the customer’s ability to control their bill.

Next year, CCW will be able to provide a much more complete picture of how the sector is changing and improving. The 2024-25 business customer complaints report will include more data about ‘non-exhausted’ complaints, where consumers did not pass through all the stages of retailer complaints procedures before contacting CCW10. We will collaborate with retailers over the next year to achieve this. Improving the data in this way will enable us to tailor CCW’s guidance, so that retailers can better target any actions needed to improve complaints handling and the customer experience.

We have also launched retailer complaint assessments. This process began in May 2024 with a pilot to develop the assessment specifically for retailers. A number of retailers have volunteered to be involved over the coming year. The new complaint assessment process is built around an in-person collaborative approach, with the aim of gaining insight into the customer experience through discussion with retailers about how specific complaints were handled. Even at this early stage, the value of this approach has been apparent in uncovering good practice, as well as learning points that will benefit customers.

In addition to this, we will continue to collaborate with MOSL to develop service standards and to press companies to rectify poor customer data.

We continue to work on our Five-Year Review recommendations, through collaboration with retailers, wholesalers, Ofwat and MOSL. We will use the number of complaints received, by CCW and by retailers, to measure how well retailers are responding to CCW’s recommendations and whether they are improving the experience of their customers. CCW’s first step will be to look at whether total complaints have decreased in 2024-25, compared to this year.

10 See Appendix 1

Non-exhausted complaints to CCW

At the request of several retailers this year, CCW has started work on how we report exhausted and non-exhausted complaints.

We define a non-exhausted complaint as any complaint that gets raised with CCW by a business customer before all stages of the retailer’s complaints procedure have been exhausted.

There are several reasons why a customer may not have gone through the retailer’s complaints procedure, including:

- Unclear signposting of the procedure that makes it hard for a customer to find or follow

- A customer not feeling happy with the retailer’s handling of its complaints procedure

- A customer starting the procedure but not receiving an appropriate level of contact/response from the retailer

When we receive a complaint, CCW assesses whether the retailer could do more to look at it, and if this is the case, we refer the customer back to the retailer.

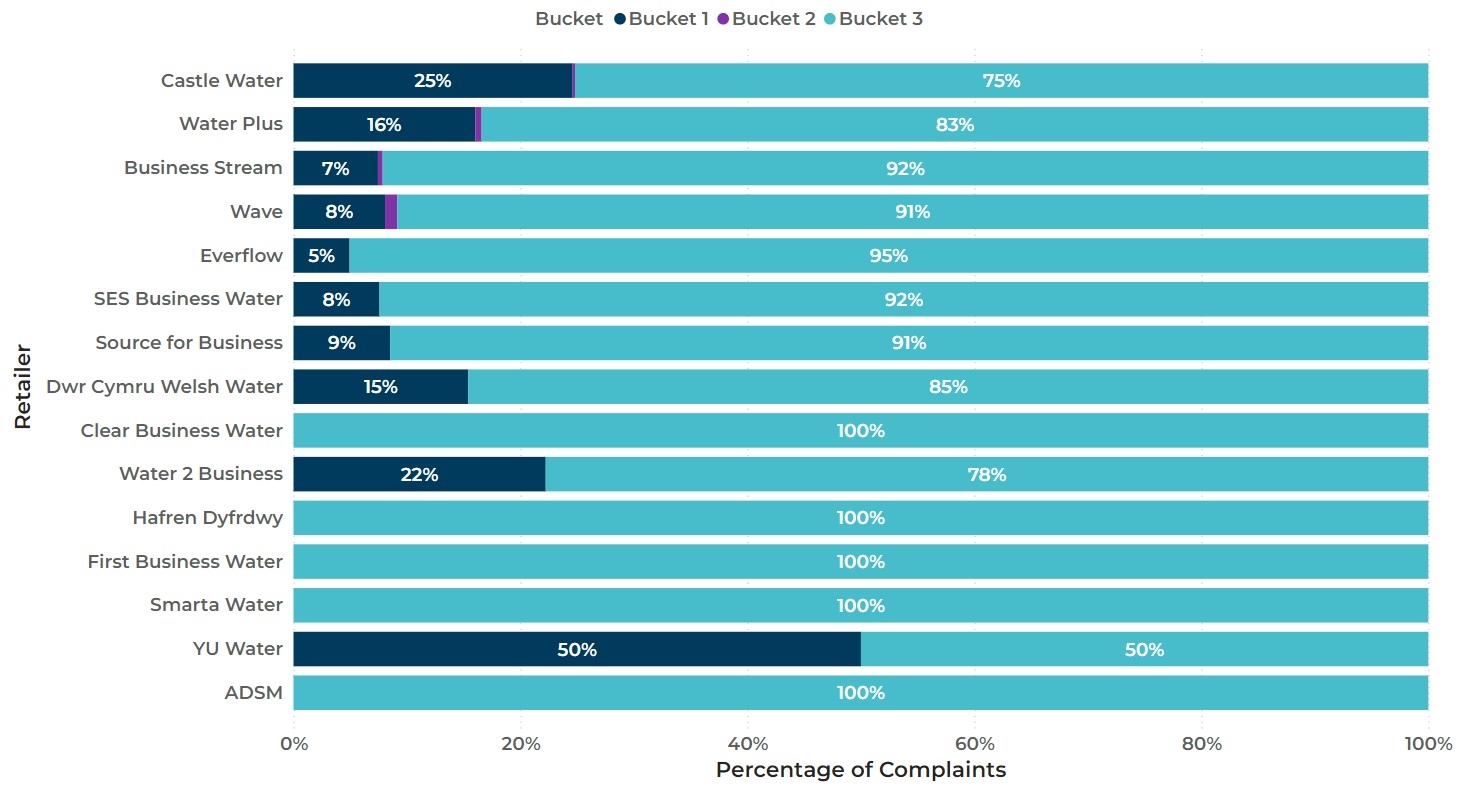

As we are still developing CCW’s approach for reporting these complaints, for this year we have used a ‘three buckets’ approach.

Bucket 1: A complaint is clearly categorised as non-exhausted by CCW and is pushed back to the retailer.

Bucket 2: A complaint has been exhausted in terms of the retailer complaint process, based on the available category information. CCW will then handle this complaint.

Bucket 3: We cannot definitively confirm one way or the other based on the category information available.

Work is underway to refine CCW’s definitions to reduce bucket 3 and will continue over the course of the next year. The aim is to have a clear categorisation for the 2024-25 Business Customer Complaint Report.

Figure 17: Non-exhausted complaints to CCW in 2023-24 per 10,000 SPIDs by retailer (preliminary categorisation only)

View full size image of figure 17 (jpg)

As we can see in figure 17 above, more work needs to be done to define when a complaint has or has not been exhausted. We will discuss this further with retailers through the year. Of those complaints classified as ‘maybe’ it is far more likely that these complaints have been exhausted.

Overview of Business Customers Complaints

Previous reports

Our most recent Business Customer Complaints reports