Ofwat consultation response on Customer Experience measures

We welcome the opportunity to provide input to Ofwat’s development of customer experience measures for PR24 Performance Commitments (PCs).

We have been consistently supportive of regulatory incentives to improve how companies serve their customers, to encourage the poorer companies to get better and the better companies to keep improving. However, Ofwat’s options for a new C-MeX in their current form will not deliver the improvement that is needed in service to customers.

Executive summary

The current C-MeX measures are not tackling the continued increase in customer complaints, as shown in CCW’s annual household complaints reports or the reduction in customers’ sense of trust in the sector.

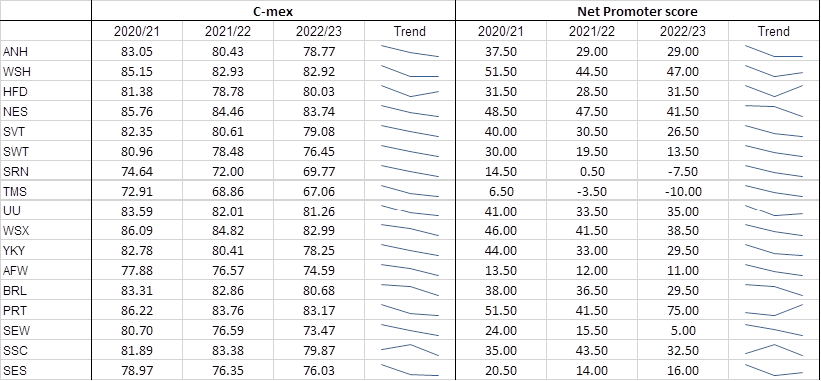

This is illustrated by the C-MeX scores reported in companies’ Annual Performance Reports for the last three years. The table below compares C-MeX and Net Promoter Scores from 2020-21 to 2022-23, and includes an indicator of the performance trend for each company. This shows that all companies have seen a decline in performance over three years [With the exception of Hafren Dyfrdwy, which has declined but shows some recovery in 2022-23.].

The declining C-MeX results, coupled with the increase in the volume of customer complaints companies and CCW have received in the last three years, shows that C-MeX in its current design is not improving the customer service experience or helping to reduce complaints. While the increase in the financial value of the C-MeX incentive from 2025 is welcome, without C-Mex being coupled to complaints volumes the financial increase alone will not reduce complaints or improve the customer experience.

High volumes of complaints are evidence of a poor experience by many customers and can be an indicator of more fundamental problems. The customer experience needs to improve if companies are to meet the needs and expectations of the people they serve.

The recommended options in the consultation paper will not adequately deliver the change that is required to improve the customer experience. To create a step change in customer experience C-MeX needs to include:

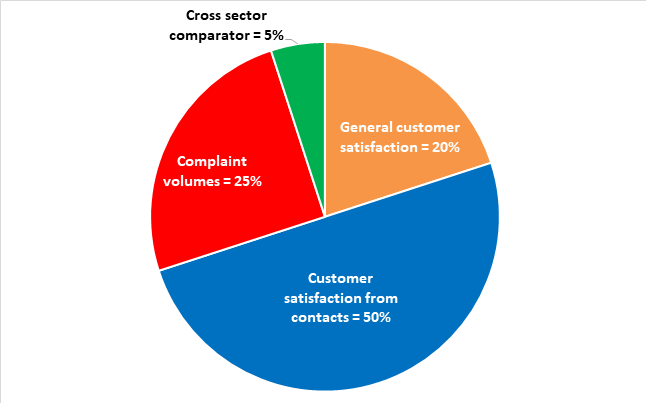

Complaints

A measure of customer complaint volumes. We want to see 25% of the value of C-MeX based on a measure of the volume of complaints a company receives. This is our single biggest issue and priority requirement for C-MeX as it is currently failing to incentive companies to improve their performance. At present, companies are motivated to give customers a good experience when they contact the company. However, there is no regulatory incentive to reduce the number of complaints they receive, particularly billing complaints which accounted for 61% of all complaints in CCW’s 2021-22 complaints report.

At present, companies can access C-MeX outperformance payments for positive results from customer satisfaction surveys, even if their complaint volumes are comparatively poor. For example, in 2021-22 Northumbrian, Severn Trent and UU had a higher-than-average volume of customer complaints, but still achieved C-MeX outperformance payments.

A greater ‘negative’ C-MeX score for escalated complaints to create a stronger incentive for companies to get the customer experience right first time during their everyday interactions with customers. The highest negative ‘score’ should be given for complaints that have escalated to a CCW investigation, which we have also seen an increase in. We know this motivates companies to provide a good customer experience, and would not be complex or laborious to implement as similar metrics were used in the earlier Service Incentive Mechanism (SIM). We would be happy to work with Ofwat in developing such measures quickly.

Customer satisfaction

A measure of customer contact satisfaction. 50% of the value of C-MeX should continue to be based on a measure of the satisfaction of customers who have contacted a company, but with more negative ‘scores’ where customers have had to repeatedly contact a company on the same issue. This will help ensure problems are resolved at first contact.

The proportion of customer contacts surveyed should be split 40:60 between operational and billing contacts. The greater weighting on billing contacts will reflect industry trends as billing and charging issues are the largest causes of customer complaints [see chart 3 on page 9 of our complaints report] and are an area of company performance not currently influenced by other Performance Commitments and incentives.

As it is not always clear what the reason(s) are for customer dissatisfaction given in both current C-MeX surveys, part of this updated C-MeX component should be complemented by in-depth qualitative research with a sample of customers to better understand the reasons for dissatisfaction, so companies can learn lessons and improve.

Cross-sector customer satisfaction comparator. We believe a comparison with customer satisfaction of water with other sectors using UKCSI benchmarks should account for 5% of the value of C-MeX. This will encourage companies to deliver a customer service experience commensurate with the experience they have with other services.

A measure of general customer satisfaction. The measure of wider customer satisfaction (i.e. not just those who have had reason to contact a company) should be retained but reduced to 20% of the value of the incentive, to accommodate the two new components covering complaint volume and a cross-sector comparator.

The case for a new C-MeX measure

We provide additional evidence and information to supplement the Executive Summary arguments:

C-MeX is not working in its current form, and won’t provide the appropriate incentives to improve service standards under the options Ofwat offers in the consultation.

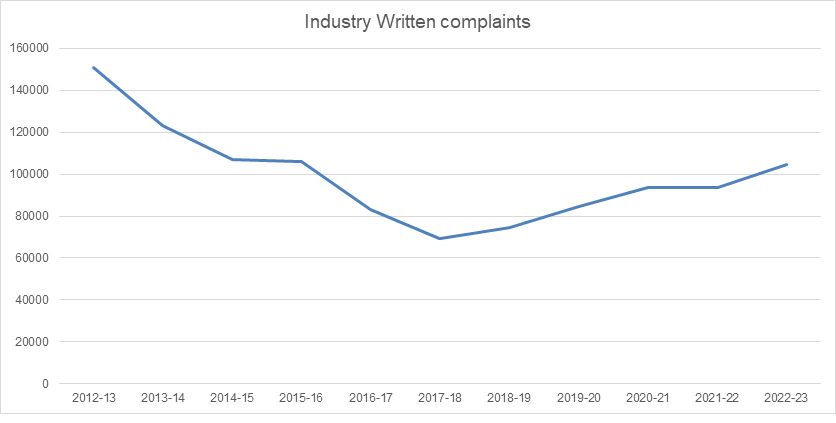

The use of performance commitments and Outcome Delivery Incentives (ODIs) across a range of service areas over the last two price controls were intended to improve service standards for customers. If service standards are improving, we would expect complaints to fall, but this has not happened and household complaints have increased since 2017-18.

The chart below shows industry written complaints from household customers since 2011-12. It illustrates that since C-MeX commenced in 2018 (after the initial pilot phase) complaints have steadily increased, only seeing a small reduction in 2021-22, before rising again in 2022-23.

Ofwat argues that there isn’t a need to include complaint volumes in C-MeX, as Performance Commitments provide an incentive to improve service standards. We disagree. The range of Performance Commitments applied in 2020-25 and proposed for 2025-30 cover operational activities when the greatest driver of customer complaints is billing and charging issues. There is currently no financial incentive for companies to reduce complaints relating to billing and charging.

Similarly, we are unconvinced that the proposed changes to companies licence conditions will adequately work as an incentive to drive complaints down, as the monitoring of company performance that is currently being considered will not incentivise the improvement that is needed.

The consultation paper considers including escalated complaints as a component (under Option 4) but Ofwat dismisses this as it says existing data on escalated written complaints is insufficiently robust (and very low numbers for smaller companies) to include within C-MeX. However, our evidence shows this is an incorrect assumption.

Stage two complaints for all channels of communication with customers are now in excess of 15,000 per year (data to be published in our household complaints report on 5 October 2023). Whilst some of the smaller companies do have small volumes of escalated complaints, we use normalised data in our analysis (e.g. per 10,000 connections) to make the data comparable.

We are also reviewing our assessments of companies’ complaints handling performance to measure how well companies are adhering to the complaint reporting guidance. This will provide Ofwat with additional assurance that companies’ data is robust and credible.

Our earlier audit of complaints in 2021-22 showed that 84% of companies were adhering to the complaint guidance, and since then companies have put measures in place to improve their compliance. Seven companies have a Quality Assurance (QA) process that can report in the same detail as our previous audit. Two more are using a slightly shorter version.

Through the CCW Complaints Forum we’re encouraging all companies to adopt a QA process that allows them to consistently report back to us their compliance with the guidance in a proportionate manner. To further help, we’ve updated the scenarios that accompany the guidance and have shared training materials for all companies to use in training front-line staff, ensuring consistency. We are happy to take Ofwat through these developments in more detail.

We disagree with Ofwat’s view that a measure of total complaints can have the unintended consequence of discouraging companies from proactively communicating with their customers and making themselves accessible. This is because there is now a greater distinction in the definition of what constitutes a ‘contact’ and ‘complaint’, which has been agreed with companies. This should assure companies that if they encourage customer contact this will not negatively impact their C-MeX score.

Our response to the consultation questions

Customer Experience (C-MeX)

No. While we agree that the weighting of the customer experience survey within C-MeX should be reduced, we think it should be set at 20% of the overall value of C-MeX. This will allow for 80% of the value to cover measures of performance on operational and billing contacts and complaint volumes. This will place a greater incentive on companies to improve the customer service contact experience and reduce complaints.

Yes, but it should be stronger. While we want to see customer contact surveys increased to 50% of the overall value of C-MeX, this element should be split 40:60 between operational and billing contacts. The greater weighting on billing contacts will reflect industry trends and help address the main causes of customer complaints.

In addition to this, the measure should give companies a more negative score if customers have had to contact a company more than once on the same issue. Following our ‘Don’t Let People Suffer in Silence’ campaign, companies can track repeat customer contacts for both billing and operational issues, with a more negative ‘score’ for companies that fail to resolve issues first time.

Companies need to understand and learn from the reasons for dissatisfaction in customer contacts, so to complement this measure; companies should conduct in-depth research with a sample of customer contacts in the surveys to explore the reasons for their poor experience.

When companies report their C-MeX performance in their Annual Performance Reports, this should include what the company has found from this more in-depth qualitative research and the actions they are taking to improve as a result.

Within the operational contact element, we agree that this should include customers affected by operational incidents, not just those who have had reason to contact the company. This would incentivise clearer communication and proactive responses to incidents. We will be issuing principles to the companies on communicating with their customers during incidents in the autumn. This will set the baseline for companies to work to, although we fully expect companies to want to stretch themselves beyond that.

Yes, but this should be stronger. We agree with the principle of using cross-sector benchmarks such as UKCSI because customer satisfaction and the customer service experience in water should be relative to the customer experience with other sectors. But this would be a stronger incentive if it represented 5% of the value of the C-MeX incentive, rather than as a threshold measure for companies to pass to gain access to maximum outperformance rewards.

Yes, but Ofwat needs to show how this will be calibrated so that each company’s potential penalties and outperformance payments act as a sufficient incentive to improve.

If it is a single % figure applied to all companies then there will be winners and losers relative to basing the incentive on allowed retail revenue. This means the level of penalty or outperformance payment should be relative to the size of the company, and set on the basis of relative targets for each company. This should motivate company Boards to focus on improving the customer service experience and growing a customer-centric culture.

The consultation paper illustrates that the value of C-MeX payments and penalties under the current method means the relative value of C-MeX is lower compared to other incentives. There is also a risk that C-MeX could continue to shrink as a share of a company’s risk and return package depending on changes to the Regulatory Capital Value of the company.

Because of this, it is important that Ofwat backs up its signalled intent to increase the size of C-MeX at subsequent periodic reviews so the incentive properties of C-MeX are not eroded by virtue of changes to the RCV.

Developer Experience (D-MeX)

Yes. We welcome Ofwat’s recognition that new appointees, small developers and self-lay providers have not been represented in the D-MeX qualitative surveys in the past, so this should result in a more representative view of the range of developers the companies serve.

Yes. We agree that Option 3 would allow for surveys to be more reflective of the percentage of water company transactions with each type of customer (new appointees, self-lay-providers etc.) but may be complex to operate (with a possible higher risk of error) as the share of transactions for each type of customer changes over time.

As well as being simpler, for this issue, Option 2’s approach is preferable as the views of new appointees and self-lay providers are still represented even if they have fewer transactions. It is important their service experience is not deprioritised simply because they have had fewer transitions in a 12-month period than in the past.

Companies should have data available on the volume and profile of the larger developers they serve based on the number of connection points, consumption and billing information to allow for a sufficient representative sample to be taken.

We agree that the quantitative metrics should be retained as this allows for comparative analysis and target setting for specific areas of developer service provision, although at a lower value than the qualitative survey element which allows for in-depth exploration of developers’ experience.

We would like to see more stretching targets in the quantitative metrics, where evidence from customer engagement (e.g. earlier qualitative research with developers) shows that customer expectations have changed. Quantitative targets should be reflective of what customers want and expect.

Yes. We agree that a greater incentive on the customer experience will focus companies on customer satisfaction while retaining the performance metrics.

Yes. By having outperformance payments or penalties based on a target that is relative to those of other companies, the incentive targets should increase over time as the better-performing companies raise the bar for others to follow.

Yes. We see benefit in having a comparative ‘league table’ that includes comparative performance across England and Wales. A separate Wales table may lessen the incentive for companies in Wales to aim for D-MeX performance that reflects the better-performing companies in England.

Yes. As Ofwat’s analysis has found little evidence of a material difference between companies’ performance in water and wastewater developer services, there is no compelling case to separate the two at this stage.

Yes. We support the move to incentive payments and penalties based on a proportion of the return of regulatory equity, for the same reason as we support this move with C-MeX in our response to Q2.4. RoRE (Returns on Regulatory Equity) based incentives can be more reflective of the size and regulatory value of the company and should be a stronger incentive as a result.

Business customer experience in Wales

Yes. We support the introduction of a common Performance Commitment for companies operating in Wales from 2025. Including a measure of satisfaction for business customers who have had reason to contact a company is welcome as it should focus companies on the customer experience and allows for some comparability with the BR-MeX measures in England.

Yes. As companies in Wales receive operational and billing contacts from business customers, survey-based metrics for each type of contact would be both transparent and incentivise companies to deliver a good level of service in both areas.

A measure of how well companies respond to operational incidents that affect business customers is also welcome, as their experience of how companies have communicated and responded is useful evidence even if they have not had a reason to contact the company. This would incentivise companies to ensure they are communicating well with customers when an incident occurs.

Yes. We agree that smaller business customers may need greater protection from poor service than larger ones, so a higher weighting for larger business customers in the sample may not fully achieve this.

We agree with this approach for 2025-30, as at present, business customers in England are less satisfied than in Wales after the opening of the business retail market, so a relative target for companies in Wales may not be adequately stretching or challenging.

However, this could change to relative targets in the future. The new BR-MeX measures for the wholesale companies in England will track customer satisfaction with wholesaler’s operational services.

Customers’ interactions with companies in Wales cover both retail and wholesale (operational) parts of the business. If companies in Wales are eventually found to be comparatively worse than companies in England, the targets for Wales could take into account the level of customer satisfaction with wholesalers in England to help ensure customers in Wales receive the same (or higher) level of operational service.

Yes, as this allows for some comparability with C-MeX for domestic customers.

Yes. As explained in responses to questions on D-MeX and C-MeX on the use of the Regulatory Return on Equity (RoRE) as a basis for incentive payments, this should be a better reflection of the size and value of the company and should ensure the incentive leads companies to have a greater focus on how well they are serving business customers.

No, as it is unclear why companies would require thresholds to prevent both outperformance payments and penalties above or below set levels. A cap applied to prevent customers from paying excessive rewards for a company’s out-performance would be welcome, but a collar to limit penalties may soften the incentive for companies to improve.